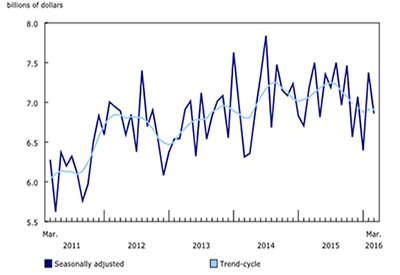

Building permits, March 2016

May 10 2016

The total value of building permits issued by Canadian municipalities was down 7.0% to $6.9 billion in March, marking the second decline in three months. The decrease, which followed a 15.3% gain in February, was largely the result of lower construction intentions for commercial buildings in Alberta, Ontario and British Columbia.

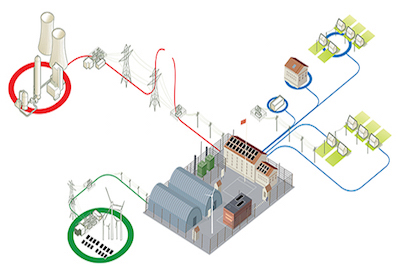

Chart 1

Total value of permits

In the non-residential sector, the value of building permits was down 22.8% to $2.4 billion in March, following a 32.6% increase the previous month. Declines were reported in half the provinces, with Alberta responsible for most of the drop, followed by British Columbia and Ontario.

The value of residential permits rose 4.8% to $4.4 billion in March, a second consecutive monthly increase. Gains were posted in seven provinces, led by Ontario, British Columbia and Nova Scotia. The largest decline in residential construction intentions was reported in Alberta.

Non-residential sector: Lower construction intentions for all three components

All three components of the non-residential sector decreased in March, led by commercial buildings.

The value of permits for commercial buildings was down 27.7% to $1.5 billion in March, partially offsetting the 56.6% increase in February. At the national level, the decline was mainly the result of lower construction intentions for recreational facilities and retail complexes, which recorded large increases the previous month. Decreases were posted in five provinces, led by Alberta, followed distantly by Ontario and British Columbia.

In the institutional component, the value of permits was down 12.2% to $591 million in March, after posting an increase of 17.5% the previous month. The decrease resulted mostly from lower construction intentions for secondary schools, other government buildings and health clinics. Declines were posted in five provinces, most notably Alberta, Quebec and Saskatchewan. Ontario registered the largest advance in the component.

The value of industrial building permits was down 17.1% to $395 million in March, a second consecutive monthly decline. Lower construction intentions for maintenance-related buildings, utilities buildings and manufacturing plants were responsible for much of the decrease. The decline was spread among five provinces, led by Manitoba. The biggest increase was recorded in Alberta.

Chart 2

Residential and non-residential sectors

Residential sector: Higher construction intentions for multi-family dwellings

Construction intentions for multi-family dwellings rose 12.1% to $2.0 billion in March. Gains were reported in every province, except Alberta. Ontario posted the largest advance, followed by British Columbia and Nova Scotia.

The value of permits for single-family dwellings edged down 0.5% to $2.4 billion, following a 10.0% increase in February. Declines were spread among five provinces, led by British Columbia. Ontario recorded the most notable increase.

Municipalities approved the construction of 15,674 new dwellings in March, down 1.4% from the previous month. The decline resulted from single-family dwellings, which fell 7.9% to 5,623 new units. Conversely, multi-family dwellings were up 2.6% to 10,051 new units.

Provinces: Alberta records the largest decline

The total value of building permits was down in four provinces in March, with Alberta posting the largest decrease, followed by British Columbia and Saskatchewan.

In Alberta, the value of building permits dropped 41.3% to $931 million, following a 43.3% increase in February. Construction intentions declined in every component, except industrial buildings. Commercial buildings and multi-family dwellings accounted for most of the decrease.

The value of building permits in British Columbia was down 5.2% to $1.1 billion in March, registering a third consecutive monthly decline. The drop was the result of lower construction intentions in every component, with the exception of multi-family dwellings. Commercial structures accounted for the majority of the decrease.

In Saskatchewan, the value of building permits fell 27.8% to $127 million, a third consecutive monthly decline. The decrease came from a drop in construction intentions for institutional buildings, which were at their lowest level since October 2014, and single-family dwellings.

Census metropolitan areas: Edmonton posts the largest decrease

In March, the value of building permits was down in 14 of the 34 census metropolitan areas. The decline was mainly attributable to lower permit values in Edmonton, Oshawa and Victoria.

The value of building permits in Edmonton fell 64.8% in March, following a record high in February. The decrease was the result of lower construction intentions for commercial buildings and, to a lesser degree, multi-family dwellings and institutional structures.

In Oshawa, the decline was attributable to lower residential construction intentions, mainly single-family dwellings, while in Victoria, multi-family dwellings and commercial buildings were responsible for the decrease.

Source: Statistics Canada; www.statcan.gc.ca/daily-quotidien/160505/dq160505a-eng.htm