January GDP Rises for 4th Month

March 31 2016

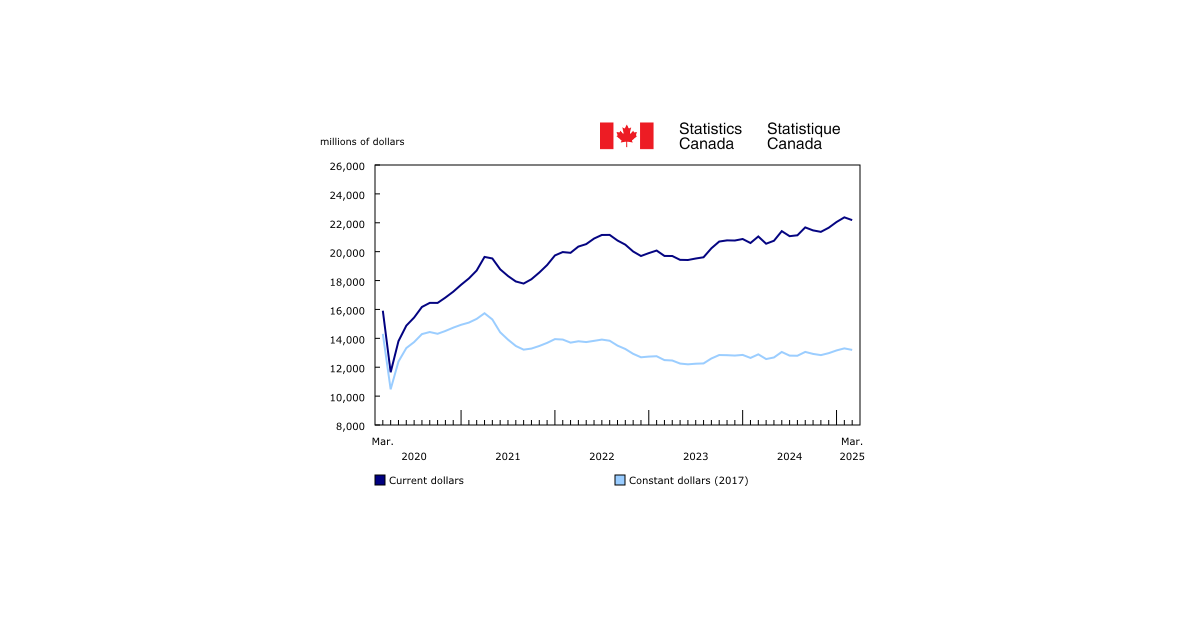

Real gross domestic product rose 0.6% in January, a fourth consecutive monthly increase. Manufacturing, retail trade, and mining, quarrying, and oil and gas extraction were major contributors to growth in January.

The output of goods-producing industries grew 1.2% in January, mainly as a result of increases in manufacturing and mining, quarrying, and oil and gas extraction. Utilities, construction, and the agriculture and forestry sector also rose.

The output of service-producing industries rose 0.4%, a fourth consecutive monthly gain. Notable increases were posted in retail trade, the finance and insurance sector, the public sector (education, health and public administration combined) as well as transportation and warehousing services. In contrast, wholesale trade and the arts, entertainment and recreation sector declined.

Chart 1: Real gross domestic product rises in January

Manufacturing output expands again

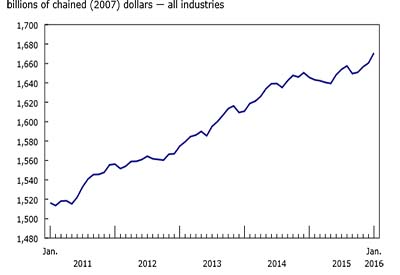

Following a 1.1% gain in December, manufacturing output expanded 1.9% in January.

Chart 2: Manufacturing output expands again in January

Durable-goods manufacturing rose 2.6% in January, after expanding 1.2% in December and 0.9% in November. Gains were notable in the manufacturing of motor vehicles and parts, fabricated metal products, and non-metallic mineral products in January. In contrast, machinery manufacturing decreased.

After rising 1.0% in December, non-durable goods manufacturing grew 1.1% in January, mainly as a result of gains in food manufacturing. Conversely, the manufacturing of beverage and tobacco products as well as chemicals declined.

Mining, quarrying, and oil and gas extraction rises

Mining, quarrying, and oil and gas extraction rose 0.9% in January, after decreasing 0.1% in December.

Oil and gas extraction grew (+1.4%) for the fourth consecutive month in January, mainly as a result of an increase in non-conventional oil extraction. The conventional oil and gas extraction industry also increased in January.

Following a 6.8% decrease in December, support activities for mining and oil and gas extraction grew 2.3% in January, partly because of an increase in drilling services.

In contrast, mining and quarrying (excluding oil and gas extraction) decreased 1.1% in January after rising 2.1% in December, mainly as a result of a decline in copper, nickel, lead and zinc mining.

Retail trade expands while wholesale trade declines

After contracting 1.7% in December, retail trade expanded 1.5% in January. Increases were notable at motor vehicle and parts dealers, general merchandise stores (which include department stores), and health and personal care stores. In contrast, sales at food and beverage stores declined.

Wholesale trade declined 0.2% in January, after rising for two consecutive months. Wholesalers of building material and supplies, farm products, and miscellaneous products (which include agricultural supplies) recorded a decrease. The wholesaling of machinery, equipment and supplies as well as personal and household goods rose.

Utilities up

Utilities were up 2.7% in January. Electricity generation, transmission and distribution increased 3.0% in January, following a 2.7% decline in December. Natural gas distribution rose 3.0% in January after falling 3.5% in December.

The increases in utilities in January were partly attributable to a return to more seasonal weather during the month. In December, unseasonably warm weather in many parts of the country had resulted in lower demand for electricity and natural gas.

Finance and insurance sector increases

The finance and insurance sector increased 0.6% in January. Insurance services, financial investment services and banking services all advanced.

Construction grows

Construction grew 0.5% in January. Engineering construction, residential building construction and repair construction increased. In contrast, non-residential building construction declined.

After rising for three consecutive months, the output of real estate agents and brokers edged down 0.1% in January.

The public sector increases

The public sector (education, health and public administration combined) increased 0.2% in January. Educational and health care services rose, while public administration was unchanged.

Other industries

Transportation and warehousing services rose 1.4% in January, mainly as result of gains in rail and pipeline transportation.

The arts, entertainment and recreation sector decreased 1.2% in January.

Accommodation and food services increased 0.2% in January.

Source: Statistics Canada; http://www.statcan.gc.ca/daily-quotidien/160331/dq160331a-eng.htm?cmp=mstatcan.