Q3 2016 Investment in Non-residential Building Construction Down 0.5%

December 15, 2016

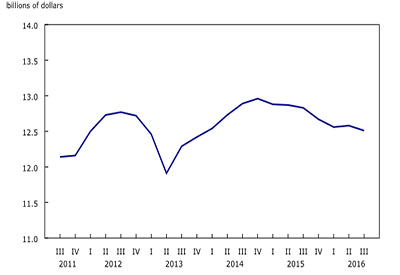

Investment in non-residential building construction totalled $12.5 billion in the third quarter, down 0.5% from the previous quarter. This was the sixth decrease in seven quarters dating back to the first quarter of 2015. The decline in the third quarter reflected lower spending on commercial and industrial building construction, which more than offset higher investment in institutional buildings.

Investment fell in five provinces, with Alberta and British Columbia posting the largest declines.

In Alberta, investment declined for the sixth consecutive quarter. The decrease in the third quarter resulted from lower investment in commercial and industrial buildings. Conversely, construction spending on institutional buildings has increased since the third quarter of 2014.

Investment in British Columbia fell in the third quarter following nine consecutive quarterly gains. The decrease was attributable to lower investment in all three components, with commercial buildings posting the largest decline.

In contrast, the largest advance occurred in Quebec, followed by Manitoba.

In Quebec, spending on non-residential building construction rose for the first time in nine quarters, as a result of higher investment in the industrial and commercial components.

In Manitoba, investment rose as a result of higher spending in all three components, with commercial projects accounting for most of the gain. This was the second consecutive quarterly increase for the province.

Census metropolitan areas

Spending on non-residential building construction was down in 13 of the 34 census metropolitan areas in the third quarter. Toronto, Calgary and Vancouver recorded the largest declines.

After edging up for two consecutive quarters, investment fell 2.9% in Toronto. The decrease was mainly attributable to lower spending on commercial buildings and, to a lesser extent, industrial buildings. In Calgary, construction spending was down for the third consecutive quarter. The decrease in the third quarter was largely the result of lower investment in commercial projects. In Vancouver, all three components contributed to the decline, with commercial buildings accounting for most of the drop.

The largest gain occurred in Winnipeg, where investment was up mainly as a result of higher spending on the construction of commercial buildings. This was the second consecutive quarterly rise for Winnipeg. London posted the second largest increase, with all three components contributing to the advance.

Commercial component

Spending on commercial building construction fell 1.6% to $7.2 billion in the third quarter, following a 0.8% increase the previous quarter. The decline at the national level was primarily attributable to lower spending on office buildings, warehouses and hotels.

Declines were recorded in six provinces, with Alberta posting the largest drop, followed distantly by Saskatchewan and British Columbia.

In Alberta, investment was down 5.6% from the previous quarter to $1.6 billion in the third quarter. The decline reflected the near completion of some large commercial projects, mainly warehouses and office buildings.

Commercial investment decreased 10.5% to $229 million in Saskatchewan, as a result of lower spending in several categories of commercial buildings.

In British Columbia, investment fell 2.6% to $949 million in the third quarter, following five consecutive quarterly advances. The decline was attributable to lower investment in a variety of commercial buildings, including hotels, office buildings and warehouses.

Conversely, Quebec and Manitoba recorded the largest gains in commercial investment.

In Quebec, commercial building construction rose for the second consecutive quarter, up 2.5% to $1.2 billion in the third quarter. The advance came mainly from increased spending on office buildings and, to a lesser extent, restaurants and automotive dealerships.

Investment grew 8.2% to $247 million in Manitoba, mostly as a result of higher construction spending on office buildings, and retail and wholesale stores.

Industrial component

Investment in industrial projects was down 2.5% from the second quarter to $1.7 billion in the third quarter. The decline was attributable to lower investment in the construction of manufacturing plants and utilities buildings, which was moderated by a 7.8% gain in the construction of primary industry buildings.

Investment in industrial projects fell in five provinces in the third quarter, with Ontario and Alberta contributing the most to the overall decline in the component.

In Ontario, investment fell 4.1% to $793 million, as lower spending on manufacturing plants and utilities buildings more than offset higher investment in primary industry and maintenance buildings.

Spending on industrial projects decreased 11.8% to $248 million in Alberta, because of declines in all industrial building categories, except primary industry buildings.

Conversely, Quebec posted the largest advance, up 9.6% to $376 million in the third quarter, largely as a result of higher investment in manufacturing plants and primary industry buildings. This was the third consecutive quarterly gain for the province.

Institutional component

Investment in institutional building construction rose 2.9% from the previous quarter to $3.5 billion in the third quarter, following two consecutive quarterly declines. Higher spending on the construction of educational institutions was largely responsible for the advance at the national level.

Investment in institutional projects rose in five provinces, with Ontario and Alberta posting the largest advances.

In Ontario, construction spending increased 3.0% to $1.3 billion in the third quarter, following three consecutive quarterly declines. The increase was due to educational buildings and, to a lesser extent, nursing homes and retirement residences.

In Alberta, investment in institutional projects rose 5.1% to $708 million in the third quarter, the ninth consecutive quarterly increase. The advance in the third quarter came primarily from higher investment in educational buildings, and nursing homes and retirement residences.

In contrast, British Columbia and Quebec posted the largest declines in spending on institutional buildings. In British Columbia, investment fell 4.2% to $356 million, mainly as a result of lower investment in medical facilities.

In Quebec, spending totalled $629 million in the third quarter, down 1.9% from the previous quarter. This was the eighth consecutive quarterly decline. Lower investment in the construction of health care facilities, and nursing homes and retirement residences more than offset higher investment in educational institutions.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/161014/dq161014a-eng.htm.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 22](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)