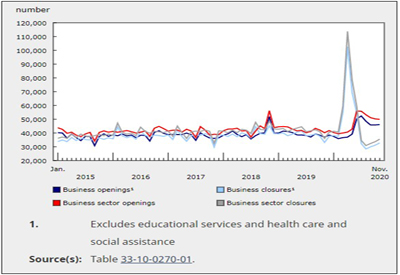

Business Openings Continue to Exceed Closures, But Closures Rising

Mar 1, 2021

While the number of business openings (49,956) exceeded the number of business closures (35,533) for the fifth consecutive month, business closures have continued to increase since August. From October to November, business closures rose by 5.6% and business openings decreased by 0.6%. The number of active businesses in November edged up from the previous month and remained 4.5% lower than in February 2020.

Business closures increased in all provinces and territories from October 2020 to November 2020, except in Yukon, where they remained unchanged. Since August 2020, there has generally been a gradual increase in business closures across the country. In Quebec and Ontario, there were 2,425 (46.9%) and 2,032 (17.5%) more business closures in November compared with August, respectively. This may be attributable to an increase in public health restrictions to limit the spread of COVID-19 during the resurgence.

Except for mining, quarrying, and oil and gas extraction and for utilities, business closures increased in all industries from October 2020 to November 2020. They continued to rise in the industries that were the most impacted at the beginning of the pandemic; since October 2020, closures have increased by 20.3% (+91) in arts, entertainment and recreation; 13.9% (+270) in other services (except public administration); and 12.7% (+190) in accommodation and food services.

New series on educational services, health care and social assistance, and food and beverage manufacturing are now available

The experimental series on monthly openings and closures are now produced for an expanded definition of the business sector at the national and provincial levels. The expanded business sector includes the educational services and the health care and social assistance sub-sectors, which contain a larger share of private businesses. For instance, offices of dentists are included, while hospitals are excluded. The series will be presented and analyzed in each release going forward. It shows a similar trend in openings and closures than the business sector series that excludes both industries.

The experimental series on monthly openings and closures also now include estimates for food manufacturing (North American Industry Classification System [NAICS] 311), as well as beverage and tobacco product manufacturing (NAICS 312), at the national and provincial levels.

All of these industries experienced a large increase in business closures at the onset of the pandemic. Compared with one year earlier, business closures in April 2020 increased by 284.0% (+274) in educational services, 184.3% (+1,142) in health care and social assistance, 172.8% (+261) in food manufacturing, and 125.0% (+50) in beverage and tobacco product manufacturing. Since April 2020, business closures have gradually decreased in these industries, but they were higher in November 2020 compared with the previous month.

Similarly to trends observed in the business sector, the increase in business closures in these industries since the onset of the pandemic has led to fewer active businesses, particularly in May and June 2020. In November 2020, there remained a gap of 6.4% (or 616 businesses) in active businesses in educational services relative to the pre-pandemic level in February 2020. In food manufacturing and in health care and social assistance, the gap was almost closed. In beverage and tobacco product manufacturing, the number of active businesses was at a historical high since the beginning the series.

In November 2020, 4 out of 10 business openings are new businesses

Business openings can be divided into reopening businesses and new businesses, or entrants. Reopening businesses are defined as opening businesses that were also active in a previous month (i.e., they closed in a given month and had positive employment in a subsequent month). In contrast, entrants are opening businesses that were not active in a previous month.

Prior to 2020, entrants represented 37.8% of monthly business openings in the Canadian business sector, on average. At the onset of the pandemic, this share fell slightly to one-third of business openings. As public health restrictions began to be eased across the country in May 2020, reopening businesses accounted for a larger share of business openings, reaching a peak of 83.8% in June 2020. Since then, the number of entrants in the Canadian business sector has gradually increased, from 9,036 new businesses in June 2020 to 20,370 new businesses in November 2020; 40.8% of business openings in November 2020 were entrants.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210222/dq210222a-eng.htm?CMP=mstatcan

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)