BCCA: Declining Future Investment in BC’s Major Projects Adds to Industry’s Growing Challenges

November 4, 2024

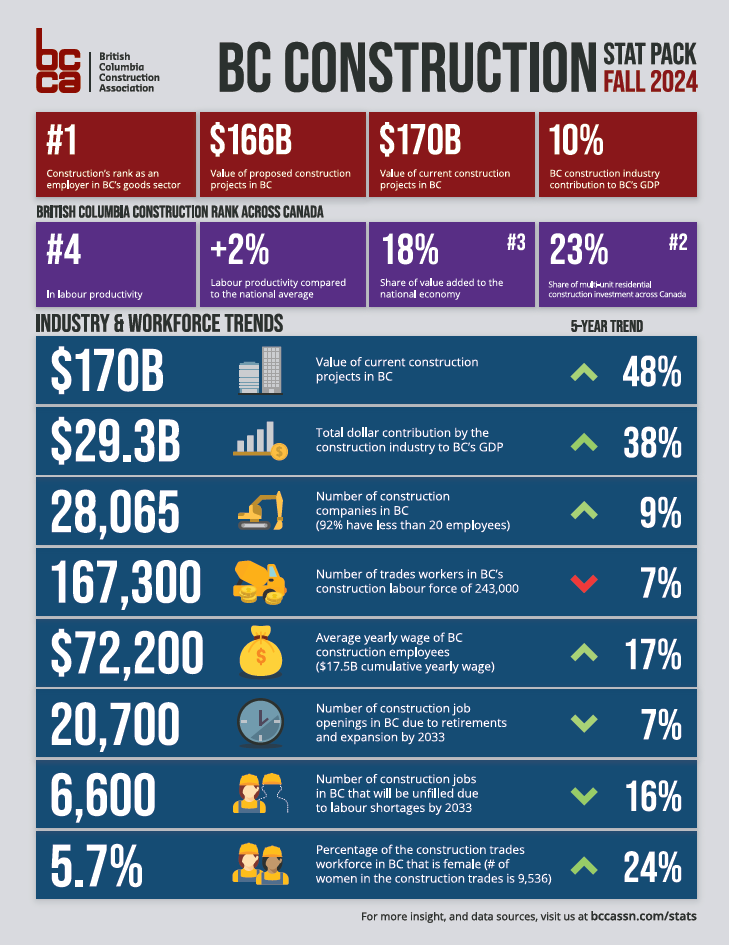

Statistics in the BC Construction Association’s (BCCA) Fall 2024 Construction Industry Stat Pack demonstrate that while the value of existing projects continues to grow, the threat of poor industry support and declining investments in major projects is alarming. The industry faces intense pressure to meet the current demand due to persistent workforce shortages, high labour costs, and lack of payment certainty.

The issue facing the industry is two-pronged. Firstly, the construction industry seeks increased investments in major infrastructure projects. Since Spring 2024, the value of proposed major infrastructure projects has decreased in value by five per cent and nearly 20 per cent over the past five years, which makes the future of the industry look problematic as current major projects begin to wind down with no guarantee of being adequately replaced.

“British Columbia’s construction industry will be paramount to building our province’s critical infrastructure and alleviating the housing crisis,” said Chris Atchison, President of the BC Construction Association. “During the election campaign, BC’s political party leaders committed to supporting the construction industry. Now that the results have been finalized, we need the government and opposition caucuses to work together to implement policies geared towards payment certainty and workforce development to ensure the construction industry can meet the current and future demand to build BC better.”

British Columbia is in high demand for major infrastructure projects. Hospitals, schools, multi-unit housing, bridges, and supporting infrastructure across the province must be built. Still, the decreasing value of proposed construction projects suggests that the Province is not invested in making these a reality.

This decrease in investments is coupled with the concurrent need for more robust support mechanisms to ensure that said projects can be delivered. The underlying factors of payment uncertainty, workforce shortage, and high labour costs pose significant strains on the construction industry, which need to be addressed by our political leaders.

Despite the need for major infrastructure investments and commitments from every party in that regard during this recently completed election, British Columbians cannot wait and need our political leaders to work together to recommit advancing major projects, attracting external investment, and creating more favourable conditions for significant projects to get approved. With the election now behind us, it’s time to get BC’s political leaders back to the legislature and to work with industry on the pressing issues impacting construction and the building of BC.

To consult the Fall 2024 BC Construction Industry Stat Pack, visit www.bccassn.com/2024FallStatPack/

Details regarding data sources can be found at www.bccassn.com/2024FallStatPackSources/.

KEY BC CONSTRUCTION INDUSTRY STATISTICS

- Number of construction jobs in BC that will be unfilled due to labour shortages by 2033: 6,600, an increase of 600 compared to 2032 forecasts made in Fall 2023.

- Construction is the No. 1 employer in BC’s goods sector.

- BC’s construction industry accounts for 10% of the province’s GDP. A 16% increase over the past 5 years.

- 243,000 people rely directly on BC’s construction industry for a paycheque.

- Number of workers in trades jobs: 167,300, an increase of 3,400 since Fall 2023 but still a 5-year trend decrease of 7%

- The number of women in construction trades is 9,536 (5.7%), an increase of over 2,100 since Fall 2023 and a 5-year trend increase of nearly 15%.

- Number of construction companies in BC: 28,065, an increase of over 200 since Fall 2023.

- The average yearly wage of BC construction employees is $72,200 ($17.5B cumulative annual wage), a slight decrease since Spring 2024 but a 5-year trend increase of 17%.

- Value of proposed construction projects in BC: $166 billion, a decrease of $4 billion since Spring 2024.

- The estimated value of current major construction projects underway in BC: $170 billion, an increase of $10 billion since Spring 2024 and a 5-year trend increase of nearly 50%.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)