2022 Electrical Contractor Survey: Labour Demand

March 13, 2023

By Blake Marchand

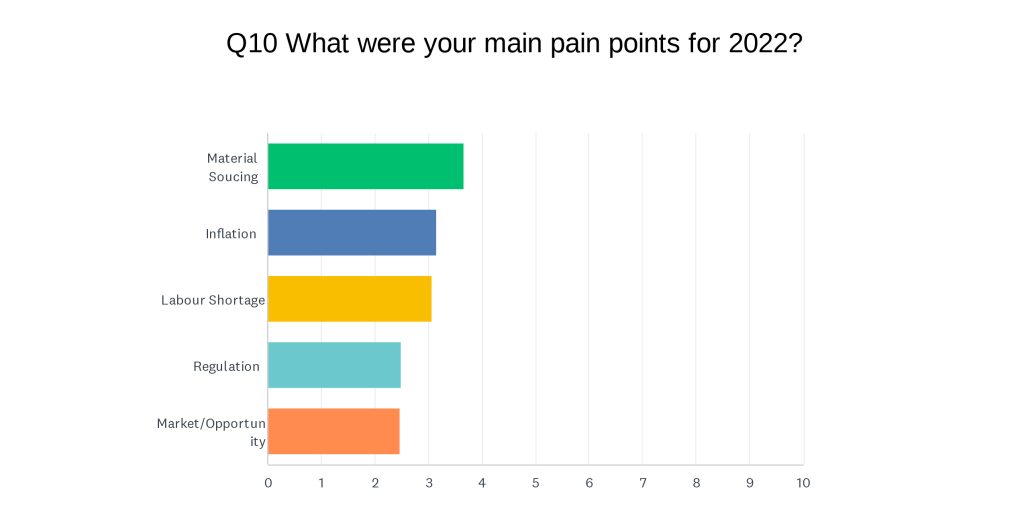

In this article we take a look at the impact labour demand had on electrical contractors in 2022 based on our survey of electricians and electrical contractors. The first article in this series focused on supply chain and material availability, which was the main theme of the survey with respect to pain points of those surveyed. When asked about trends impacting their businesses, over 100 contractors singled out supply chain/inflation as a challenge, while 58% of respondents listed material sourcing/inflation as their number one pain point. You can find that article HERE.

The next most significant challenge besides economic concerns for contractors in 2022 and looking ahead to 2023 was labour. 18% of respondents listed labour as their top pain point for 2022. Nearly 50% of respondents listed labour shortage in their top three challenges for the year.

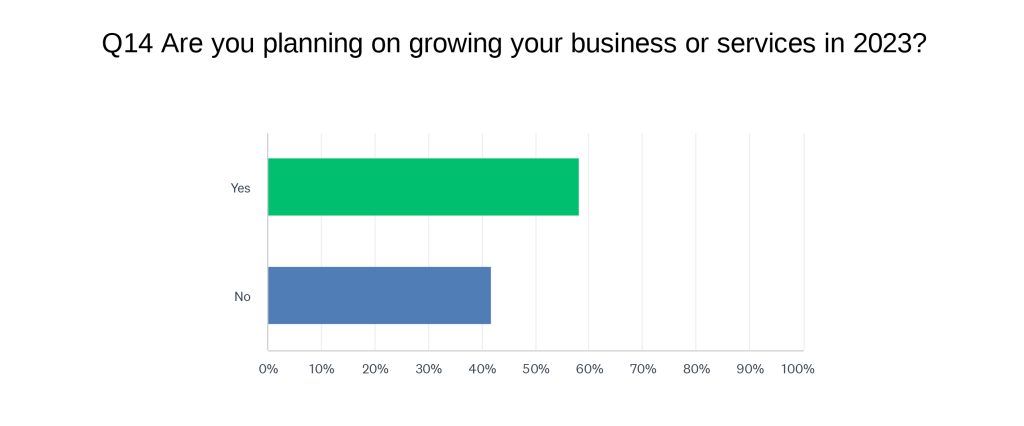

Looking ahead to 2023, 27% of respondents had plans to grow their business – out of those contractors that planned on growing their business, 60% said that their ability to find quality labour would factor into growth.

The challenges associated with labour demand come down to finding qualified electricians as well as apprentices.

A heavy majority of those surveyed were non-union, smaller operations. As a result, cost, and journeyperson/apprentice ratio factors into their ability to take on new apprentices. Several respondents singled out 1:1 ratios as a factor in their ability to take on a new apprentice in 2023. The ability to find qualified journeypersons to begin with was another issue.

An Ontario contractor with company size of 11-20, in response to our question about significant trends in 2022, commented that, “Can’t find electricians, can’t hire and train more apprentices because of the ratios. This is a catch 22, that will never fix itself as electricians retire.”

The trend around labour is concerning because of the projected demand for electricians moving forward. Not just with electrification, but with projected demand in construction, as well as with projected retirements.

The federal government has recognized this with their incentive for SME (small and medium sized enterprises) to hire apprentices. The investment offers $5,000 to take on an apprentice and up to $10,000 to take on an apprentice from equity-deserving groups. Go HERE for more information on the organizations distributing funding.

However, that obviously doesn’t address a shortage of certified electricians in the short term. Out of 99 respondents that specified what will factor into their growth for 2023, 40% said that labour will be a key factor in their ability to grow their business or a reason why they didn’t have plans for growth. Many of which specified finding qualified electricians.

Nova Scotia has increased the number of apprentices a journey person can train from one to two to help meet demand for labour. In B.C. they adjusted the rules as well, going to a two apprentice to one journey person ratio and exempting level 4 apprentices from that ratio. Ontario has been investing in training and promoting skilled trades to young people.

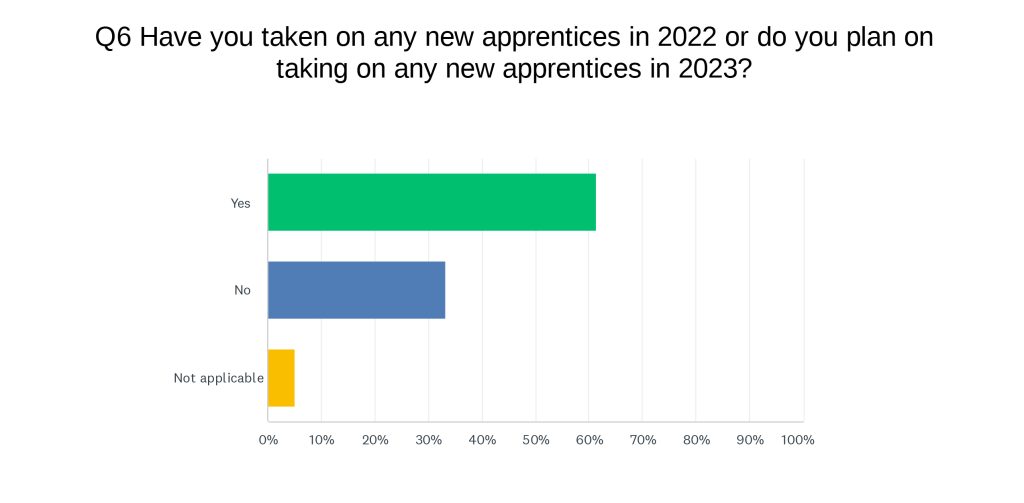

The electricians that responded to our survey seemed to recognize the importance of bringing apprentices into the trade, 67% took on an apprentice in 2022 or had plans to take one on in 2023. 33% of respondents had no plans to take on an apprentice. Of those electricians several didn’t have the need as they were downsizing or planning on retiring in the next couple of years. A handful cited the cost associated with taking them on, and another handful said they need qualified electricians to do so.

In terms of location for electricians that cited labour demand as a key issue Ontario (40%) held the highest percentage followed by Alberta (24%) and B.C (13%) while we had a handful of electricians dealing with labour challenges from Manitoba, Saskatchewan, Nova Scotia, Quebec, NWT, Yukon, and Newfoundland and Labrador.

The higher percentages in the top three provinces likely has more to do with population and portion of our audience rather than the severity of labour demand in those areas compared to others. If anything, it signifies the severity of labour demand across the country. Given that Ontario, Alberta, and B.C have the largest populations (this survey didn’t target Quebec, our sister publication LME did a similar survey in French), it goes to reason that those provinces also have the larger talent pools.

Demand for skilled trades in Canada data shows that B.C, Ontario, Manitoba, and Atlantic Canada do not have enough apprentices in industrial electrician pipeline and Saskatechewan and the teritories are similarly at risk for construction electricians. The CAF-FCA report on apprenticeship that the above link draws from notes that there is more than enough apprentices in the pipeline for construction electricians in BC, Alberta, Ontario, Quebec, and Atlantic Canada. While Quebec is the only province where required certifications for industrial electricians exceeds the projected apprenticeship completions.

Industrial electricians are an at risk trade nationally and need more apprentices in the system to meet the projected demand, as CAF-FCA report concludes. For construction electricians the concern would be more around having enough certified electricians to take on apprentices.

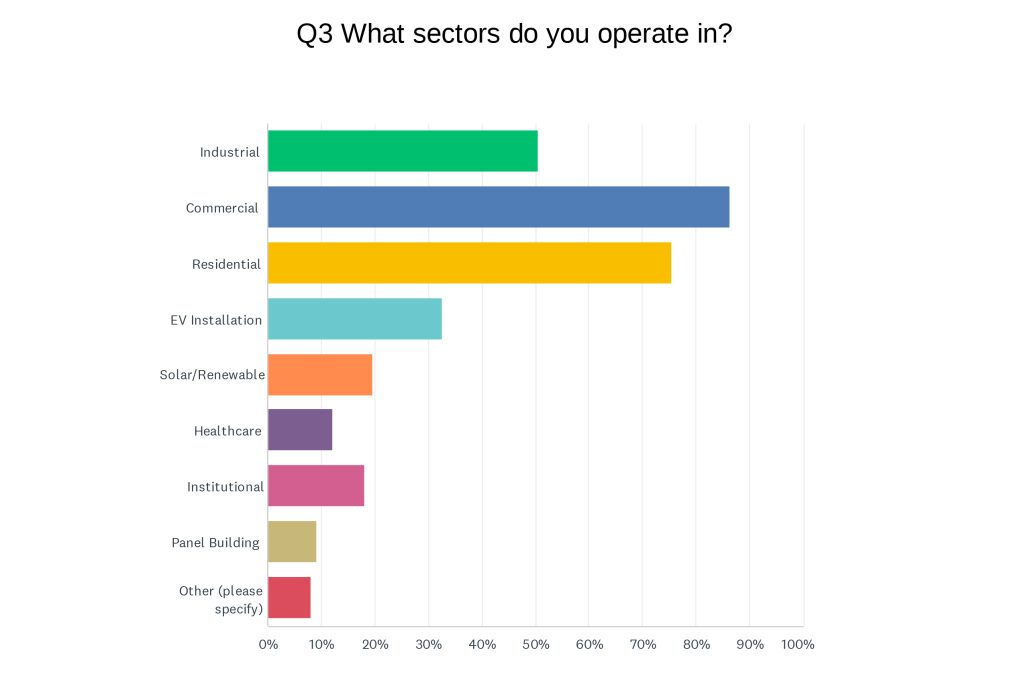

Here is the industry breakdown of the contractors we surveyed. 50% operated in Industrial, 86% in Commercial, and 75% in Residential.

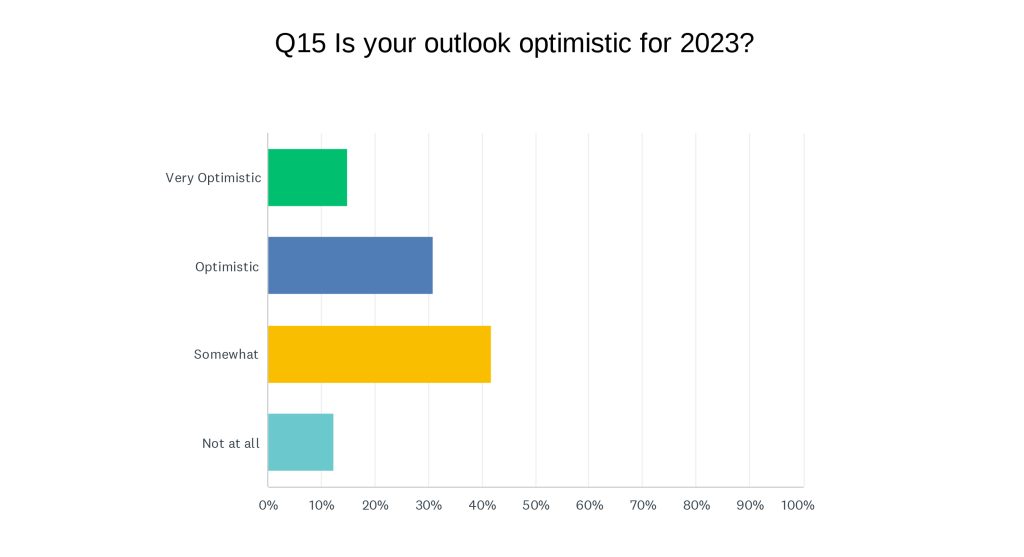

Despite that challenges facing electrical contractors in Canada, economic uncertainty, material availability and supply chain, and the growing demand for skilled labour, the majority of electricians we surveyed remained cautiously optimistic for 2023.

Thanks to everyone who participated in the survey! We’ll have more content unpacking the responses over the next couple months. Towards the end of the year, we’ll follow up with another survey to gauge how electrical contractors faired in 2023.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)