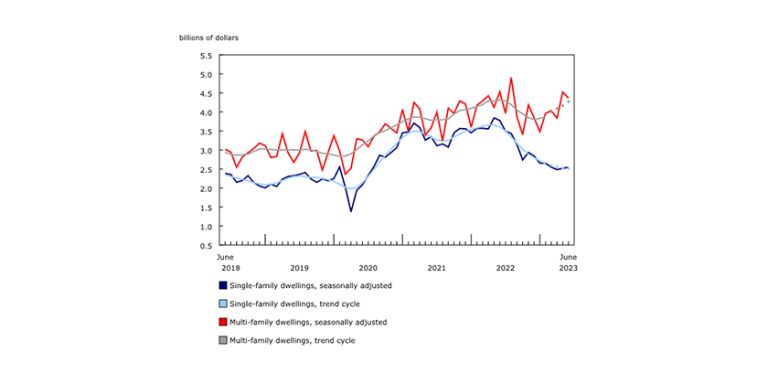

February GDP Stable Following January Decline

Real gross domestic product (GDP) was unchanged in February following a 0.2% decline in January. An increase in the output of service industries, primarily retail trade, was offset by an overall decline in goods-producing industries.

Real GDP growth was revised down to a 0.2% decline in January 2015 and revised up to a 0.4% increase in December 2014. Revisions to January and December result from the incorporation of updated information on Canadian industries.

The output of service-providing industries edged up 0.1% in February, after declining 0.2% in January. Increases were recorded in retail trade and the finance and insurance sector as well as the public sector (education, health and public administration combined). On the other hand, wholesale trade, transportation and warehousing services as well as accommodation and food services posted declines.

Goods production declined 0.2% in February, after edging down 0.1% in January, primarily as a result of declines in manufacturing and mining, quarrying and oil and gas extraction. Construction also declined in February. In contrast, utilities and the agriculture and forestry sector were up.

Chart 1: Real gross domestic product is unchanged in February

Retail trade rises while wholesale trade falls

After declining for two consecutive months, retail trade rose 1.5% in February as most subsectors posted growth. There were notable increases at

• general merchandise stores

• food and beverage stores

• sporting goods and hobby, book and music stores

• motor vehicles and parts dealers

Activity was down at gasoline stations and building material and garden equipment and supplies dealers.

Chart 2: Retail trade rises in February

Manufacturing output decreases

Manufacturing output declined 0.8% in February after decreasing 0.7% in January.

Following a 1.5% decline in January, durable-goods manufacturing fell 2.5% in February. There were notable declines in the manufacturing of transportation equipment as well as of primary metals, non-metallic mineral products, and fabricated metal products. In contrast, miscellaneous manufacturing was up.

Non-durable goods manufacturing rose 1.4% in February, mainly as a result of a notable increase in the manufacturing of chemical products and, to a lesser extent, of food.

Mining, quarrying, and oil and gas extraction falls

Mining, quarrying, and oil and gas extraction fell 0.6% in February, mainly because of a contraction in support activities.

Support activities for mining and oil and gas extraction contracted 15.4% in February, after falling 10.8% in January, as rigging and drilling services retreated. Crude oil prices, while up in February from January, have been significantly lower in recent months compared with their mid-year 2014 levels. Natural gas prices were down again in February, their sixth decline in seven months.

After rising 1.4% in January, oil and gas extraction edged up 0.1% in February, primarily as a result of gains in non-conventional oil extraction. The growth was pulled down by a decline in conventional crude petroleum extraction, while natural gas production was up.

Mining and quarrying (excluding oil and gas extraction) increased 3.0% in February. An increase in metallic mineral mining outweighed a decline in non-metallic mineral and coal mining.

Finance and insurance sector grows

The finance and insurance sector grew 0.7%, a third consecutive monthly increase. Financial investment, banking, and insurance services all posted gains.

Construction declines

Construction declined 0.2% in February. Residential and non-residential building construction fell, while repair construction was up. Engineering construction was unchanged.

After falling for five consecutive months, the output of real estate agents and brokers rose 3.3% in February, as activity increased in the home resale market, mainly in British Columbia and Ontario.

Other industries

Utilities grew 2.3% in February, after increasing 1.7% in January. Electricity generation, transmission and distribution as well as natural gas distribution were up, partly a result of colder than usual temperatures in some parts of the country.

The public sector (education, health and public administration combined) increased 0.2%.

The agriculture and forestry sector was up 1.1% in February. Growth in crop production and the forestry sector outweighed a decline in animal production.

Chart 3: Main industrial sectors’ contribution to the percent change in gross domestic product, February 2015

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/150430/dq150430a-eng.htm.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 34](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)