Market Report on DC Distribution Networks

The market for direct current (DC) distribution networks encompasses several disparate opportunities — telecommunications towers, data centres, grid-tied commercial buildings, and off-grid military networks — that revolve around different market assumptions, dynamics, and drivers. The industry is currently focused on medium-voltage DC distribution networks — systems that are mostly concentrated on the data centre market segment, but which can also apply to commercial buildings.

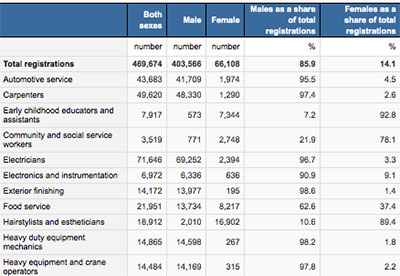

A heated debate continues about the advantages and disadvantages of DC. The majority of progress in developing DC-based technologies has occurred at either the high-voltage (more than 1,000V) or low-voltage (less than 100V) level. Since microgrids and building-scale nanogrids typically operate at medium voltage (roughly 380V–400V), much work needs to be done to bridge this voltage innovation gap. Another challenge facing DC distribution networks lies with the need for standards and open grid architectures that can help integrate the increasing diversity of resources. Yet, there is momentum at the distribution level of electricity service to diversify power offerings and pursue hybrid solutions that incorporate a growing proportion of DC. According to Navigant Research, implementation revenue in the global DC distribution network market is expected to grow from $2.8 billion in 2015 to $5.1 billion in 2024 under a base scenario.

This Navigant Research report analyzes the global market for DC distribution networks in four key segments: off-grid/bad grid telecommunications, data centres, commercial building grids, and off-grid military applications. The study provides an analysis of the market issues, including opportunities, drivers, and implementation challenges, associated with DC distribution networks. Global market forecasts for capacity and implementation revenue, broken out by segment, region, and scenario, extend through 2024. The report also examines the key technologies related to DC distribution networks, as well as the competitive landscape.

Key questions addressed:

• What are the efficiency and control advantages of direct current (DC)?

• What applications of DC power make sense today? Tomorrow?

• What efforts are being made to create new standards for DC medium-voltage products?

• Which segments are leading this market?

• Which companies are the lead pioneers with DC technologies?

• How does DC fit in with the current push related to microgrids for resiliency?

• What unique safety issues need to be addressed in order for DC to become fully commercialized?

Find out more: www.navigantresearch.com/research/energy-technologies/microgrids-energy-technologies

Navigant’s Microgrids Research Service focuses on alternative distributed energy resource (DER) networks and related platforms that add enhanced resilience, redundancy, and security to the electrical distribution system. The service features research and analysis covering microgrids, nanogrids, virtual power plants, and direct current distribution networks, along with an in-depth examination of deployment strategies, enabling technologies, policy and regulatory factors, business and financing models, and applications for these networks in various industry verticals. The research includes a comprehensive strategic analysis of the market landscape in addition to detailed market forecasts, segmented by technology, world region, and application area.