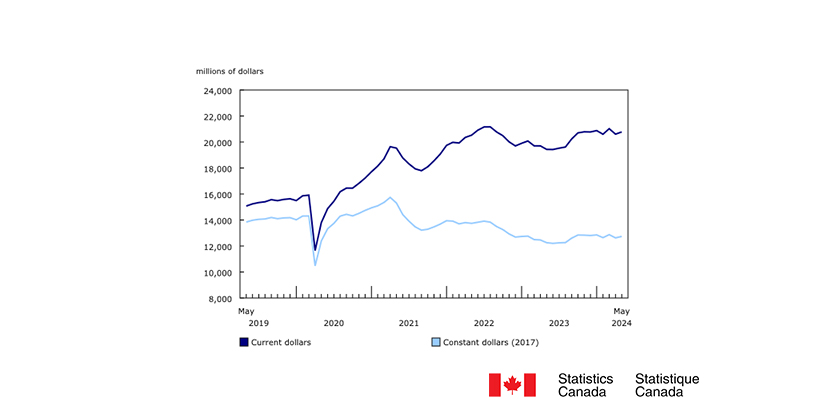

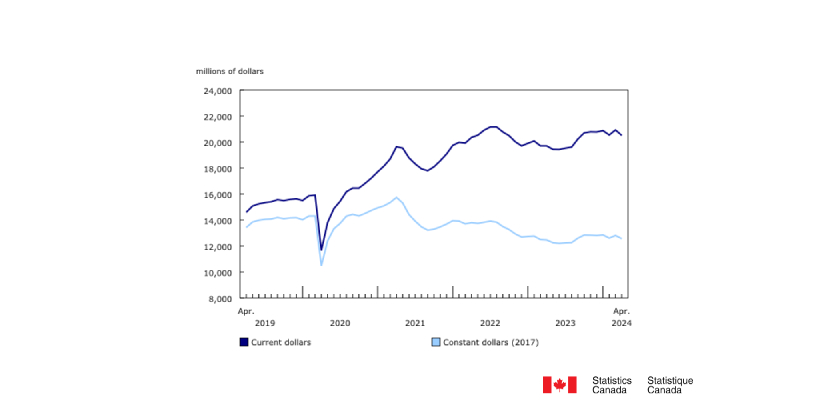

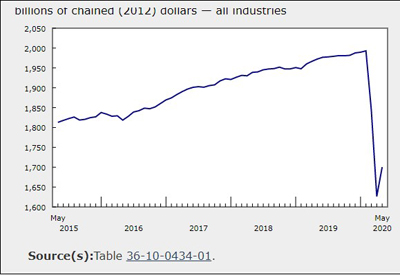

GDP Grew 4.5% in May

July 31, 2020

Real gross domestic product (GDP) grew 4.5% in May, following two months of unprecedented declines when emergency measures to slow the spread of COVID-19 resulted in widespread shutdowns. In May, provinces and territories started reopening sectors of their economies to varying degrees. While May’s gains offset some of the March and April declines, economic activity remained 15% below February’s pre-pandemic level.

Both goods-producing (+8.0%) and services-producing industries (+3.4%) were up, as 17 of 20 industrial sectors posted increases in May.

Given the unprecedented economic situation brought on by the COVID-19 pandemic and the demand for trusted information, Statistics Canada continues to provide an advanced aggregate indicator of the state of the Canadian economy. Preliminary information indicates an approximate 5% increase in real GDP for June. Output across several industrial sectors, including manufacturing, retail and wholesale trade, construction, transportation, accommodation and food services, and the public sector, increased. This flash estimate points to an approximate 12% decline in real GDP in the second quarter of 2020. Owing to their preliminary nature, these estimates will be revised on August 28 with the release of the official GDP for June and the second quarter.

Construction rebounds on gradual reopening

Construction rose 17.6% in May with all types of construction activity expanding in the month. The easing of COVID-19 construction restrictions in May, most notably in Ontario and Quebec, contributed to the largest monthly increase since the series started in January 1961.

Residential construction increased 20.4% following two months of reduced activity. Gains in multi-unit construction along with home alterations and improvements led the way, more than offsetting lower single-unit construction in May. Non-residential construction jumped 56.7% as all three components reported double-digit increases, largely offsetting the two previous months’ declines. Repairs (+18.9%) and engineering and other construction (+2.8%) were also up.

Retail trade grows

Retail trade grew 16.4%, the largest monthly increase since the series began in 1961, as 11 of the 12 subsectors were up. Motor vehicle and parts dealers contributed the most to the growth, with a 68.6% jump in May. If motor vehicle and parts dealers were excluded, retail trade would have increased 11.4%. General merchandise stores rose 19.8%, reaching a pre-pandemic level of activity. Clothing and clothing accessories (+94.8%), as well as sporting goods, hobby, book and music stores (+98.2%), bounced back as shopping malls and stores began to reopen. Furniture and home furnishings stores were up 64.2%, while retail activity at gasoline stations rose 10.9% spurred by higher demand from consumers and newly reopened businesses. Non-store retailers were up for the third consecutive month, rising 5.0% in May, as the shift toward online shopping continued. Food and beverage stores (-1.4%) were down in May after two months of elevated activity.

Manufacturing up as operations resume

The manufacturing sector rose 7.4% in May following a 22.4% decline in April, when many operations experienced full or partial shutdowns in response to local and provincial emergency measures introduced to slow the spread of COVID-19.

Durable manufacturing rose 11.2%, as 8 of the 10 subsectors increased. The transportation equipment manufacturing subsector (+30.5%) contributed the most to the growth, as all industries except aerospace products and parts manufacturing (-5.1%) were up. Most automotive plants gradually reopened midway through the month and the output of motor vehicles and motor vehicle parts slowly resumed. Miscellaneous transportation manufacturing was up 49.6%, fully offsetting the previous two monthly declines. The fabricated metal products (+9.1%) and furniture and related products (+42.5%) manufacturing subsectors were up as the majority of industries expanded, while declines in machinery (-10.3%) and primary metal (-0.4%) manufacturing offset some of the growth.

Non-durable manufacturing rose 4.0%, as seven of the nine subsectors grew. Petroleum and coal products manufacturing (+14.4%) led the growth as refineries (+13.3%) ramped up production. Plastic and rubber products (+16.7%) and beverage and tobacco manufacturing (+18.0%) were also up, while paper (-7.5%) and food manufacturing (-3.0%) declined.

Wholesale trade increases

A broad-based rebound in wholesaling activity in May led to 6.0% growth in the sector, following three months of contraction. Overall, eight of the nine subsectors were up, led by the higher output of building material and supplies merchant wholesalers (+14.4%) as construction activity restarted in many parts of the country. Personal and household goods wholesaling rose 10.7%, with the majority of industries in the subsector increasing their activity. The output of motor vehicle and motor vehicle parts and accessories merchant wholesalers jumped 28.0%, as the result of an increase in activity at motor vehicle and motor vehicle parts plants. Only machinery, equipment and supplies wholesaling (-0.9%) was down.

Healthcare and education up, while public administration contracts

The output of health and social services rose 3.3%, with increases in three of the four subsectors. Leading the growth was an 11.3% increase in ambulatory health care as offices such as physicians, dentists and diagnostic laboratories gradually reopened across the country. Output remained 35% lower than February’s pre-pandemic level, as many offices opened at a greatly reduced capacity, limiting the number of appointments to limit the spread of COVID-19. Hospitals (+0.5%) and social assistance (+2.2%) were also up, while nursing and residential care facilities (-2.3%) declined. Educational services rose 6.7%, while public administration (-1.8%) contracted for the third consecutive month.

Real estate and rental and leasing increase

Real estate and rental and leasing increased 1.5% in May following a 3.4% decline in April. Activity at the offices of real estate agents and brokers jumped 57.1% in the month, as home resale activity in nearly all major urban centres increased in conjunction with a large increase in the number of newly listed homes. Nevertheless, the output of real estate agents and brokers remained 44% below February’s level.

Transportation and warehousing up for the first time in five months

The transportation and warehousing sector rose 1.7%, following four consecutive monthly declines. Overall, 6 of the 10 subsectors were up, led by a 6.0% increase in truck transportation and a 2.3% increase in transportation support activities, as demand increased after businesses began to reopen. Postal services, couriers and messengers (+5.8%), and warehousing and storage services (+2.8%) rose in May, as continued growth in online shopping and atypical holiday-like volumes of parcels kept demand high for these services.

While air transportation edged up 1.9% in May from April’s all-time low, it was still 96% below January’s level before the COVID-19-related travel advisories and restrictions began. Rail (-0.1%) and water (-2.2%) transportation remained low throughout May, as most of the domestic and international travel restrictions aimed at slowing the spread of COVID-19 remained in place. Transit, ground passenger and scenic and sightseeing transportation declined 12.0% in May. A decrease in urban transit services (-10.6%)—attributable to a decrease in ridership and service offerings by transit corporations contracted—and a continuing decline in other transit and ground passenger transportation and scenic and sightseeing transportation (-25.7%) more than offset a 25.8% bounce-back in taxi and limousine services.

Accommodation and food services up

Accommodation and food services rose 24.2%. Activity at food services and drinking places rose 35.1% in May as dining rooms and patios began to open in certain parts of the country, while other restaurants continued relying exclusively on take-out and delivery. Meanwhile, accommodation services dropped 2.3%, as ongoing restrictions on international and interprovincial travel kept most Canadians in their own beds.

Other industries

Mining, quarrying, and oil and gas extraction increased 2.4% in May primarily as a result of increased metal ore mining. Oil and gas extraction (-2.7%) decreased for the fourth time in five months as conventional crude oil production fell to its lowest level since December 2016, while natural gas extraction increased. Support activities for mining, and oil and gas extraction declined 5.9%, mainly because of lower drilling and rigging services.

The professional, scientific and technical services sector was up 1.8% in May, following two months of decline resulting from the restrictive measures implemented to contain the spread of COVID-19. Most industries increased in May.

Finance and insurance grew 0.7% as increases in depository credit intermediation and monetary authorities (+0.8%), and insurance carriers and related activities (+1.2%) offset a decline in financial investment services, funds and other financial vehicles (-0.7%).

Utilities edged up 0.5% in May as growth in electric power generation, transmission and distribution (+1.0%) more than offset lower natural gas distribution (-2.9%).

Arts and entertainment declined 2.9% in May because of a decline in performing arts, spectator sports and heritage institutions as sports arenas remained empty, with zero professional sports games played for the second consecutive month. Amusement and recreation activities were also down, while gambling activities increased.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200731/dq200731a-eng.htm?CMP=mstatcan