Residential Sector Continues to Fall for June Bulding Construction Investment

August 31, 2023

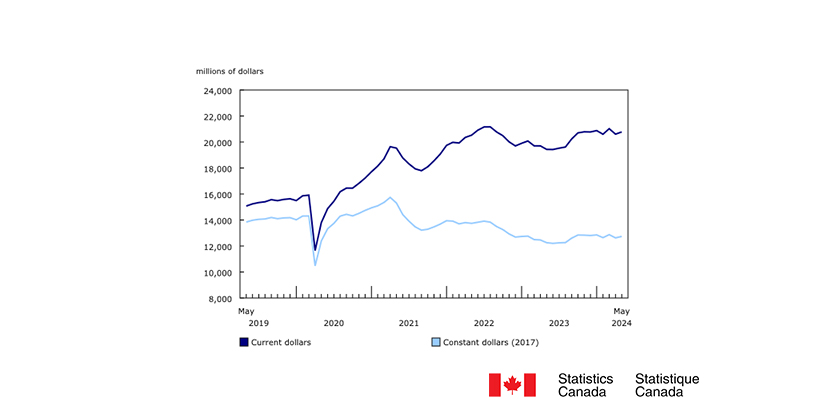

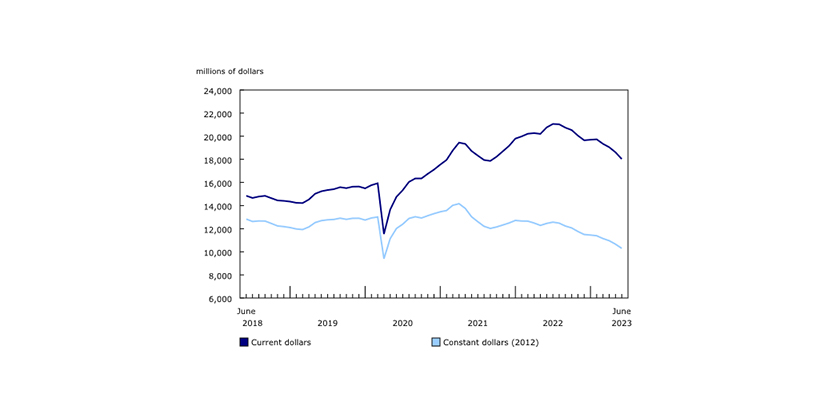

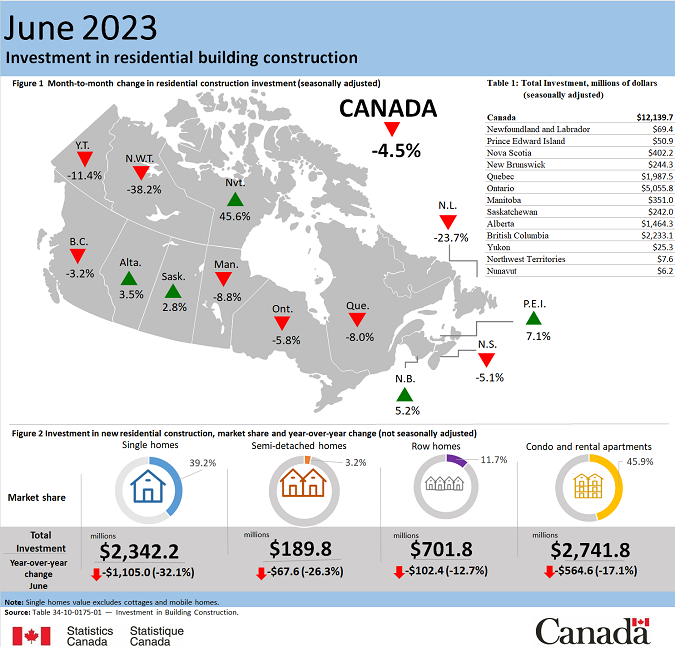

Investment in residential construction declined for the fourth straight month, falling 4.5% to $12.1 billion in June. Investment in non-residential construction edged down 0.2% to $5.9 billion. Overall, investment in building construction fell 3.1% to $18.0 billion in June.

After adjusting for inflation (2012=100), investment in building construction decreased 3.4% to $10.3 billion.

Residential sector continues to fall

Residential construction declined for the fourth consecutive month, falling 4.5% to $12.1 billion in June. Ontario (-5.8% to $5.1 billion) accounted for most of the drop.

Single family home construction fell 5.7% to $6.2 billion in June, with declines seen in eight provinces.

Multi-unit construction declined for the eighth straight month, falling 3.1% to $5.9 billion in June, the lowest level since September 2021.

Second quarter of 2023 declines due to residential sector

Overall investment in building construction declined 5.2% to $55.7 billion in the second quarter, entirely due to a drop in residential construction (-8.2% to $37.9 billion). Non-residential construction was up 1.8% to $17.8 billion.

Investment in single family homes fell 10.5% to $19.7 billion in the second quarter, the largest decline since the second quarter of 2020. Multi-unit construction declined for the third straight quarter, falling 5.7% to $18.2 billion in the second quarter of 2023.

Investment in non-residential construction rose 1.8% to $17.8 billion in the second quarter, the 10th consecutive quarterly increase. Investment in industrial buildings rose 5.6% to $3.7 billion, while commercial construction increased 1.7% to $9.8 billion.

Institutional construction decreased 0.9% to $4.4 billion, with Quebec (-4.6% to $1.3 billion) accounting for most of the decline.

For more information on construction, please visit the Construction statistics portal.

For more information on housing, please visit the Housing statistics portal.