2022 Electrical Contractor Survey: Material Availability and Price Volatility Increasing Risk for Electrical Contractors

February 6, 2023

By: Blake Marchand

There are several factors that have led to uncertainty when it comes to material availability and product prices fluctuation in the electrical market. Primarily, those factors stem from global events that influence the broader market – the value and demand of raw materials, the cost of shipping, the cost of storage, as well as the price of energy all impact manufacturing and supply.

The global pandemic’s impact on supply chain has been clearly establish, those issues have been exacerbated by the Russia/Ukraine war in some ways. For example, both countries produce aluminum, copper, and steel; uncertainty from the war causes a ripple effect on the price of those materials produced in other countries. Additionally, energy and fuel costs have also fluctuated over the past few years – while demand for products only rose due to economic recovery-related investments. Labour shortages in manufacturing are also a contributing factor.

Manufacturers have been actively trying to combat those challenges to meet demand, however some of those obstacles are beyond control. An example of that is PVC conduit. Some reports suggest shortages could persist into 2023 and 2024. There were a number of impacts that have contributed to that shortage, including several natural disasters that caused disruptions for the plastics industry along the Gulf Coast. On top of that, demand for PVC products grew. The push toward e-commerce caused more investment in warehouses, for example, and infrastructure investments into bridges and roads have kept demand high.

As material availability and price volatility increase risk, particularly for smaller operations that don’t have the purchasing power or cash flow of larger operations, contractors have to find ways to adjust to the impact of market conditions to maintain their profit margins.

As part of our 2022 Electrical Contractor Survey, we asked electricians how material availability/price volatility is impacting their quoting process and in turn their ability to complete a job profitably. A few of the contractors we surveyed weren’t particularly concerned or impacted, but the majority found that material price volatility has made quotes more difficult, adding stress to their bottom line.

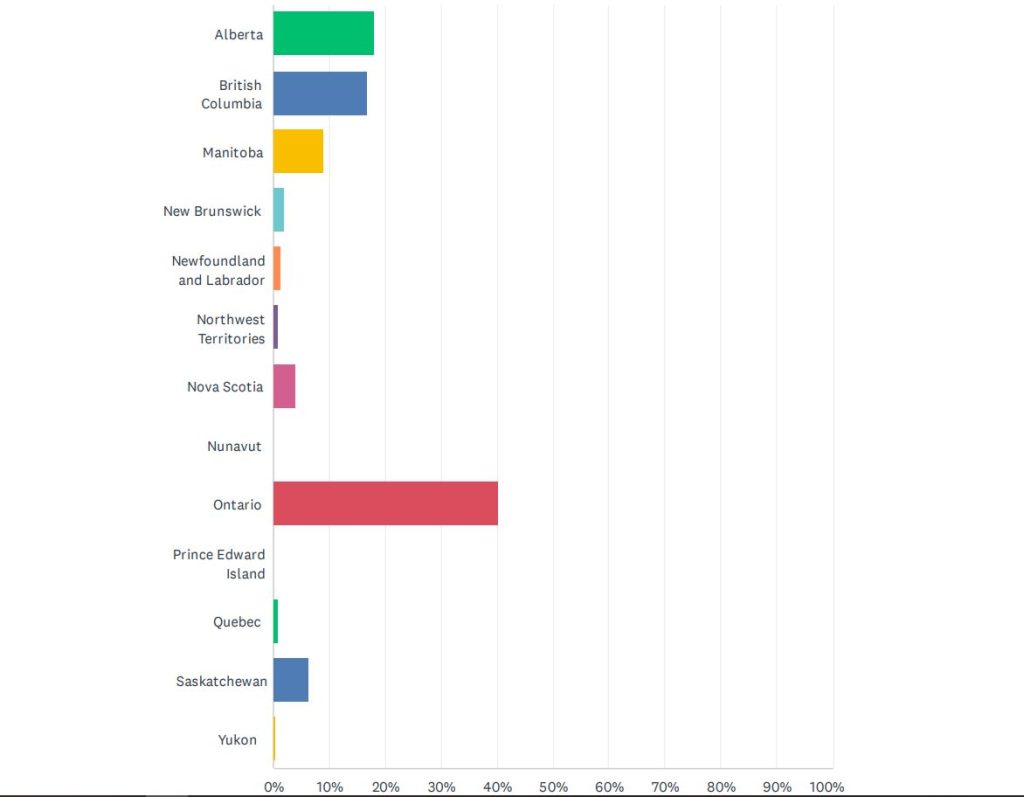

Here is the breakdown of where the contractors surveyed are located:

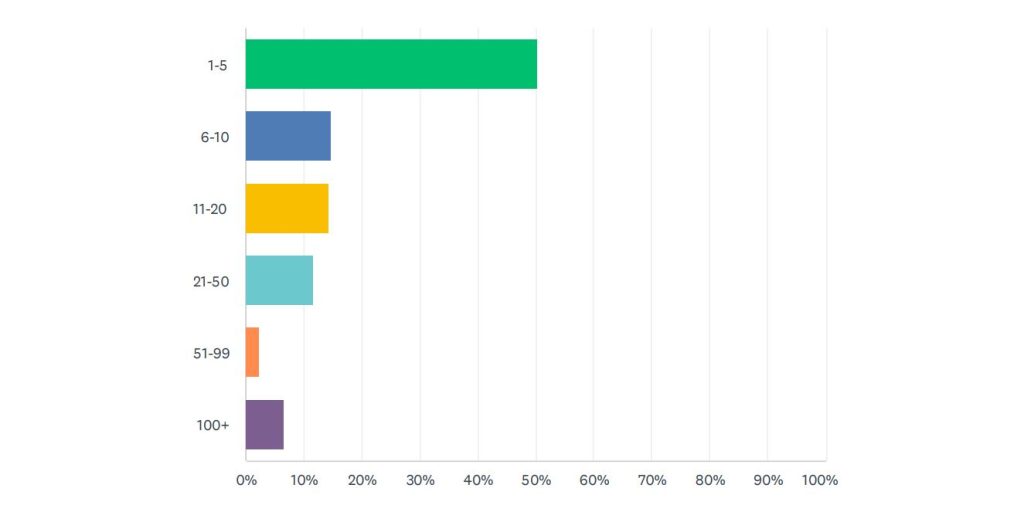

Also, for context, 50% of the contractors we surveyed were from businesses with 1-5 employees:

Multiple contractors said they are only holding quotes for seven days, a commented 10 days. While distributors are holding prices on wire for 5 days in some cases. A few contractors noted that in some instances, prices can change by the day or even by the hour.

In adjusting to these conditions, some of the contractors we surveyed are buying the product immediately/as soon as possible for a particular project so they don’t lose money on the quote. That also puts them at risk because it impacts cashflow and they might lose money if the project falls through. Others are shortening the time frame a quote is applicable to as mentioned, others are building markups into quotes, or including language in the quote that covers price increases.

The latter seems like an important distinction. Contractors shouldn’t be left to bear the additional costs caused by factors out of their control.

Price volatility and material availability also means contractors have a harder time hitting project timelines or guaranteeing when a project will be completed. This is particularly challenging for longer term projects. It leads to project delays or even cancellation.

Some best practices we heard were, as mentioned, building language into quotes that accounts for potential price increases, escalation costs at the time of close, requiring deposits, and shortening the timeframe when quotes are valid.

One contractor noted they are carrying more stock of certain products.

One respondent noted they have included small increases in every aspect of the quote to account for material price volatility. Some contractors have stopped quoting or have started quoting higher in anticipation of fluctuation.

“I do more detailed quotes and ask for more quotes from suppliers than before. Supplier quotes are usually good for 5 days,” commented a contractor out of B.C.

We heard from some contractors that clients are not always understanding of the impacts of price volatility and material shortages, although we also heard that for at least one contractor, clients are very understanding. Some clients will be facing similar issues in their business and as a result will be more price conscious.

Ultimately, volatility leads to increased risk for contractors.

“We cannot hold pricing like we used to,” said one contractor out of Alberta, “We will get a winning bid and either need to buy the material right away and hold on to it (affecting our cash flow) or risk the increase in cost when we need it to install for the project.”

“We price jobs and if we are successful, we need to purchase material immediately so we can hold our price and have material when needed,” said an Ontario contractor/business owner. “This puts pressure on cash-flow, and we now need more storage containers for this material. It also opens the doors to more theft.”

As this respondent mentions, carrying more stock to avoid the negative impacts of price fluctuations also means you have to store it somewhere. If you don’t already have the space, that’s an additional expense.

“I don’t quote cable anymore due to pricing only being held for 5 days,” said a small Alberta contractor.

“I have had to absorb material price increases for 2021-2022. The products rise in price faster than we can get price increases from the builders,” commented a contractor from Manitoba, who operates in the residential sector.

Contractors are cutting it close to losing money on projects, and as a result some contractors we heard from have stopped quoting longer term projects.

“It comes down to availability as opposed to price of goods, so quoting is still the same just different costs,” said one contractor out of Manitoba.

“People don’t want to pay these prices. Materials alone are up 20-30%,” said another respondent out of Manitoba.

“You can quote a job, but delivery, especially on specific things, is a nightmare,” commented another respondent.

A contractor out of Saskatchewan is only holding quotes for two days. The volatility has also increased the time it takes to quote a project because you need to continually check prices to give accurate estimates. However, time is ultimately labour and that can be built into the quoting process. As one contractor noted, they are adding incremental increases to their quote to account for the additional time and risk involved with the fluctuating prices.

Several respondents said they are quoting projects multiple times.

“We are having to quote work and then re quote it prior to starting construction to ensure the project is still profitable,” commented a small B.C. contractor.

“We cannot guarantee brand names on products because availability is volatile. When quoting, we quote the most expensive brand of product because there is no guarantee we can get the lower end models,” said an Ontario contractor that operates in the residential sector.

Digitizing the quoting process with software that can also track your budget and cash flow is another option to streamline your process and save time and money in the long term, although it does require the additional cost of purchasing or subscribing to the software service.

One of the more surprising takeaways from this aspect of our survey was general contractors doing their own electrical work to avoid the additional expense. As electrical contractors are having to quote jobs higher and higher due to price increases, a contractor out of Manitoba commented that, in the residential sector, general contractors are doing their own work without permits. Which. Obviously, is a concerning development for safety as well as opportunity for electrical contractors.

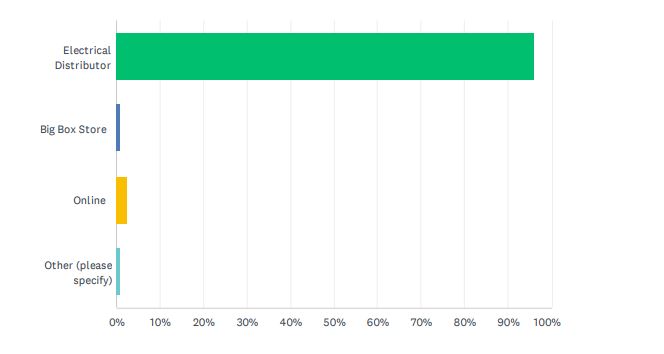

64% of the electricians we surveyed said there was no change in their product sourcing habits in relation to pre-pandemic work. Although, 20% are sourcing more from big box stores and online. While others noted they source from multiple distributors. Overall, 96% of respondents are still sourcing the majority of their material from electrical distributors.

Based on our survey, the products most impacted by supply chain disruptions are wire and cable, PVC conduit, and distribution equipment like panels and breakers.

Thanks to everyone who participated in the survey! We’ll have more content unpacking the responses over the next couple months. Towards the end of the year, we’ll follow up with another survey to gauge how electrical contractors faired in 2023.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)