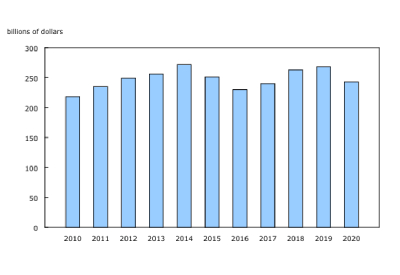

Non-Residential Capital and Repair Expenditures, 2020

August 12, 2020

Capital expenditures: Machinery and equipment — Canada

$81,974.1 million

-15.5%

The COVID-19 pandemic has resulted in a considerable slowdown in economic activity in Canada and altered the capital investment intentions of Canadian companies originally reported by Statistics Canada in February. Capital expenditures on non-residential construction and machinery and equipment are now expected to decrease 9.5% from 2019 to $242.6 billion in 2020. This compares with previously-reported intentions for 2020 of $275.5 billion, an anticipated increase of 2.8% over the previous year. The $32.9 billion anticipated decrease from previously-published data for 2020 is expected to impact both capital construction (-10.1% to $160.7 billion) and in machinery and equipment (-15.4% to $82.0 billion).

Much lower anticipated spending in both the oil and gas extraction subsector and in the accommodation and food services sector

The spread of the COVID-19 pandemic coincided with a decline in oil prices brought about by increases in global production. Even with the uptick in demand for various energy products in May, production was at its lowest level since 2017, as noted in the Energy statistics release. Consequently, capital spending in the oil and gas extraction subsector is expected to decrease by 31.7% to $22.7 billion in 2020. The decline is taking place in both conventional (-37.5% to $14.4 billion) and non-conventional (-18.6% to $8.3 billion) oil and gas industries. Prior to these events, the oil and gas subsector was expecting an increase in capital expenditures of $442 million in 2020.

International trips to Canada by nonresidents were down by 97.9% in May 2020 from the same month a year earlier, as noted in the release on Travel between Canada and other countries. Over the same period, unadjusted sales by food services and drinking places fell by half (-49.9%), as noted in the Food services and drinking places release. In this context, capital spending in the accommodation and food services sector is projected to drop 39.2% to $2.3 billion when compared with 2019, with decreases taking place in every province and territory.

While manufacturers expected a 1.2% increase in capital spending in February, they now anticipate an 18.5% decrease in capital spending in 2020 (down to $18.1 billion from $22.1 billion) when compared to 2019. A decrease is expected for both capital construction (-28.0%) and capital machinery (-14.8%), with the most notable declines observed in chemical manufacturing (-$867 million) and transportation equipment manufacturing (-$774 million). Out of 21 manufacturing subsectors, 2 reported that they were expecting a minor increase in total capital outlays for 2020.

Of the 20 industrial sectors, 3 have indicated plans to revise upwards their capital expenditures when compared with their previously-reported intentions for 2020: the health care and social assistance sector (+3.3%), the information and cultural industries sector (+1.9%), which includes the telecommunications subsector (+2.4%), and the educational services sector (+0.4%). The public administration sector, though slightly revising downward their capital spending (-0.7%), should see an increase of 1.7% in capital expenditures in 2020 when compared with 2019.

From a regional viewpoint, all provinces and territories with the exception of the Northwest Territories (+3.7%), will see their private and public expenditures in non-residential construction and machinery and equipment decrease over 2019. Newfoundland and Labrador (-22.9%) and Alberta (-19.1%) are expected to see the largest decreases, due primarily to the weakening of investments in the oil and gas extraction subsectors.