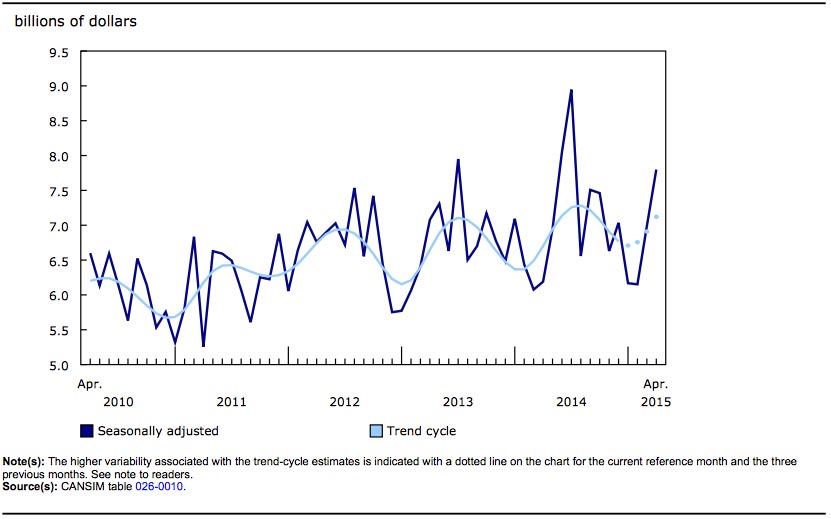

Building Permits Up in April for 2nd Straight Month

Contractors took out $7.8 billion worth of building permits in April, up 11.6% from the previous month and a second consecutive monthly advance. The gain stemmed from higher construction intentions in Ontario’s residential and non-residential sectors.

Chart 1: Total value of permits

In the non-residential sector, the value of permits rose 30.2% to $3.3 billion in April, following a 24.8% gain in March. Increases were posted in three provinces, led by Ontario, followed by Alberta and Newfoundland and Labrador. British Columbia and Quebec registered the largest declines in construction intentions for non-residential buildings.

In the residential sector, permit value rose 1.2% to $4.5 billion, a third consecutive monthly advance. Gains were noted in Ontario, Quebec, Nova Scotia and Newfoundland and Labrador. The largest decrease occurred in British Columbia, which had posted a notable increase the previous month.

Non-residential sector: notable increase in the institutional component

In the institutional component, the value of permits rose 86.2% to $1.3 billion in April, following an 83.7% gain the previous month. The national advance was attributable to higher construction intentions for medical facilities and government buildings. The value of permits rose in three provinces, with Ontario registering the largest advance, and Newfoundland and Labrador as well as New Brunswick placing a distant second and third. Quebec and Alberta posted the largest declines among the remaining provinces.

The value of permits issued for commercial buildings increased 7.8% to $1.5 billion in April. This was the second straight monthly advance. Nationally, the gain came mainly from increased intentions for retail and wholesale outlets as well as retail complexes. Increases were posted in six provinces, led by Alberta and Ontario. British Columbia recorded the largest decrease, following large gains in February and March.

Municipalities issued $480 million worth of building permits for industrial buildings in April, up 10.9% from March. This was the third increase in four months. Higher construction intentions for transportation-related buildings and utilities buildings were responsible for the advance in this component. Ontario, Alberta and Newfoundland and Labrador registered gains. Quebec and British Columbia posted the largest declines.

Chart 2: Residential and non-residential factors

Residential sector: higher construction intentions for single-family dwellings

The value of single-family dwelling permits rose 6.6% to $2.5 billion in April, marking the first increase in three months. Increases were recorded in five provinces, led by Ontario and Alberta. Saskatchewan and British Columbia registered the largest declines.

Construction intentions for multi-family dwellings fell 4.5% to $2.1 billion in April. The decline came after two strong consecutive monthly gains. British Columbia and Alberta accounted for most of the decrease, while advances were registered in Ontario, Quebec, Nova Scotia and Newfoundland and Labrador.

Nationally, municipalities authorized the construction of 17,896 new dwellings in April, down 4.5% from March. The decline came from an 8.1% drop in the number of multi-family dwellings to 12,141 units. Conversely, the number of single dwelling units increased 4.1% to 5,755.

Provinces: Ontario posted gains in all types of buildings

The total value of building permits increased in four provinces in April, led by Ontario, followed by Alberta, Nova Scotia and Newfoundland and Labrador.

The gain in Ontario occurred mainly as a result of higher construction intentions for institutional structures and residential buildings. In Alberta, the advance came from increased intentions for commercial buildings, single-family dwellings and industrial buildings. In Nova Scotia, the increase was the result of higher construction intentions for residential buildings, principally multi-family dwellings; while in Newfoundland and Labrador, the gain originated from industrial buildings.

British Columbia, which recorded an increase in March, posted the largest decline in April. This was the result of lower construction intentions in all types of buildings, with multiple dwellings accounting for much of the decrease. In Quebec, higher construction intentions for residential structures were not sufficiently large to offset the decrease registered in the non-residential sector.

Higher construction intentions in more than half of the census metropolitan areas

The total value of permits rose in 20 of the 34 census metropolitan areas in April, led by Toronto, Edmonton, Halifax and St. John’s.

The increase in Toronto was mainly attributable to institutional buildings and multi-family dwellings. In Edmonton, the gain was the result of increased intentions for commercial buildings and, to a lesser extent, single-family dwellings. The increase in Halifax came mostly from multiple dwellings, while in St. John’s, higher construction intentions for industrial buildings explained the advance.

In contrast, Vancouver posted the biggest drop, mostly as a result of lower construction intentions for multi-family dwellings and, to a lesser extent, commercial and industrial buildings. In Québec, the decline originated from lower intentions for residential structures and commercial buildings. In Kelowna, which had a notable gain the previous month, the decrease came from commercial buildings.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/150608/dq150608a-eng.htm?cmp=mstatcan.

![Guide to the Canadian Electrical Code, Part 1 [i], 25th Edition– A Road Map: Tables Section](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)