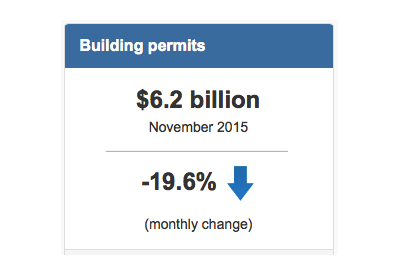

Building Permits Drop 19.6% in November

January 15, 2016

The value of building permits issued by municipalities declined 19.6% from October to $6.2 billion in November, falling below the $7 billion mark for first time since May 2015. The decrease was the result of widespread declines in both residential and non-residential sectors in most provinces, particularly Alberta.

Chart 1: Total value of permits

The value of residential building permits fell 17.8% to $4.0 billion, the third decline in four months. The decrease stemmed from lower construction intentions for multi-family dwellings in nine provinces, led by Alberta, which had posted strong gains the previous month. British Columbia, Saskatchewan and the Northwest Territories registered advances in residential construction intentions.

In the non-residential sector, the value of permits decreased 22.7% to $2.2 billion, following slight gains the two previous months. Declines were posted in seven provinces, led by Alberta, with Saskatchewan a distant second. The largest increase was in Quebec, followed by British Columbia and Ontario.

Residential sector: large decline in construction intentions for multi-family dwellings

The value of building permits for multi-family dwellings fell 33.7% to $1.7 billion, the third decline in four months. Decreases were recorded in nine provinces. Much of November’s decline came from Alberta, which had posted a record high in October. Notable decreases were also registered in Quebec and Ontario. British Columbia was the lone province to post an increase.

The value of building permits for single-family dwellings, which was fairly stable at around $2.3 billion for the last three months, edged down 0.6% in November. Advances in six provinces failed to offset declines in the other four provinces, with Alberta posting the largest decrease.

Municipalities approved the construction of 15,038 new dwellings, down 24.3% from October. The decline was mainly attributable to multi-family dwellings, which fell 33.1% to 9,450 units. The number of single-family dwellings declined 2.5% to 5,588 units.

The high prices associated with the purchase of single-family dwellings in major Canadians cities have contributed to an increasing shift in housing demand toward multiple dwellings. Beginning in 2007, multi-family dwellings have accounted for more than half of new units approved. From January to November 2015, 66.2% of new residential units approved were multi-family dwellings.

Chart 2: Residential and non-residential sectors

Non-residential: declines in all three components

Following slight gains the previous two months, the value of non-residential building permits declined in all three non-residential components. The decrease was largely the result of institutional and commercial buildings and, to a lesser degree, industrial buildings.

The value of permits for institutional structures fell 32.6% to $688 million in November, following a 36.3% advance in October and a 16.4% gain in September. Lower construction intentions for special care institutions, government buildings and medical facilities largely explained the decline at the national level. Decreases were posted in six provinces, led by Alberta and Saskatchewan. The largest increases were in Quebec and British Columbia.

In the commercial component, the value of building permits was down 20.7% to $1.1 billion in November, a third consecutive monthly decline. Lower construction intentions for office buildings, retail outlets and recreational facilities accounted for the majority of the decrease. Declines were reported in seven provinces, led by Alberta, followed by Manitoba and New Brunswick. The largest increases in the component were recorded in British Columbia and Ontario.

Industrial building construction intentions were down 6.8% to $418 million in November, the fourth decline in five months. The decrease at the national level was largely a result of lower intentions for primary industry buildings and manufacturing plants. Declines were posted in five provinces, led by British Columbia and Alberta. Ontario and Quebec recorded the largest increases.

Provinces: construction intentions down in nine provinces

The total value of building permits was down in nine provinces in November, with Alberta posting the largest decline. Saskatchewan was a distant second. British Columbia was the lone province to report an increase.

After record high construction intentions in October, largely as a result of contractors filing permits in advance of changes to the Alberta Building Code, the value of building permits in Alberta fell 56.0% to $953 million in November. The decline was the result of lower intentions for all components, led by multi-family dwellings and, to a lesser extent, institutional structures and commercial buildings.

The value of building permits in Saskatchewan was down 54.3% to $149 million in November. The decline was largely attributable to lower construction intentions for institutional buildings.

In British Columbia, the value of building permits was up 4.2% to $1.1 billion. Gains were posted in every component except industrial buildings. The advance was largely the result of higher construction intentions for institutional buildings and single-family dwellings.

Lower construction intentions in most census metropolitan areas

The total value of building permits was down in 20 of the 34 census metropolitan areas, with Calgary registering the largest decline, followed by Montréal and Saskatoon.

In Calgary, the decline resulted mainly from lower construction intentions for multi-family dwellings and, to a lesser extent, commercial and institutional buildings.

In Montreal, the decrease came mainly from institutional buildings, multiple-family dwellings and commercial buildings, while in Saskatoon the decline in the value of building permits for institutional structures largely explained the decrease.