Electrical Energy Storage: IEC Report on Present and Future Needs, Part 1

Feb 6, 2016

In the near future, electrical energy storage will become indispensable in emerging markets for smart grids and in renewable energy for reducing CO2, says the International Electrotechnical Commission. In a just-published document, the commission summarizes present and future market needs for electrical energy storage technologies, reviews their technological features, and makes recommendations for all electrical energy storage stakeholders.*

In this first of two parts, the document’s conclusions. But first, an overview of the role of electrical energy storage.

Historically, electrical energy storage has played three main roles:

• reducing electricity costs by storing electricity obtained at off-peak times when its price is lower for use at peak times

• improving power supply reliability through systems support of users when power network failures occur

• maintaining and improving power quality, frequency and voltage.

In on-grid areas of emerging market needs, electrical energy storage is expected to solve problems such as excessive power fluctuation and undependable power supply that are associated with the use of large amounts of renewable energy. In the off-grid domain, electric vehicles with batteries are the most promising technology to replace fossil fuels by electricity from mostly renewable sources.

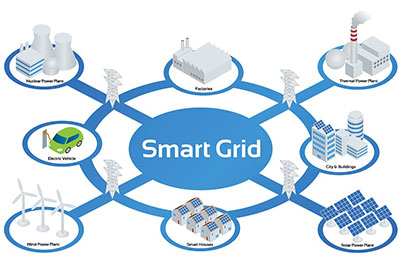

Electrical energy storage is also a key element in developing a smart grid. By addingsmart grid technologies, the grid becomes more flexible and interactive and can provide real-time feedback. For instance, information regarding the price of electricity and the situation of the power system can be exchanged between electricity production and consumption to realize a more efficient and reliable power supply.

IEC conclusions

The IEC is convinced that electrical energy storage will be indispensable in reaching the public policy goals of CO2 reduction and more efficient and reliable electricity supply and use. It is therefore essential that deployment of storage receive long-term and robust support from policy-makers and regulators.

Three major drivers determining the future of electrical energy storage have been identified:

• the foreseeable increase in renewable energy generation

• the design and rollout of smart grids

• the future spread of dispersed generation and dispersed management of electrical energy, referred to for simplicity as “microgrids”

The results of these drivers on future demand for electrical energy storage may be divided into four market segments:

• total electrical energy storage market

• conventional large- scale systems (e.g., pumped hydro storage, PHS)

• long-term storage (e.g., H2)

• dispersed storage

How these markets are expected to develop has direct implications for

• which technologies will be most needed

• which technology will need what type of further development

• what considerations will influence rollout and penetration

• what implementation problems may be expected

Conclusions regarding renewables and future grids

1. The necessary volume and timing of electrical energy storage is strongly dependent on the pace of renewable energy development, since electrical energy storage is indispensable for introducing large amounts of renewable energy.

2. Autonomous operation, easy extension and coordination with grids are important characteristics of future electrical energy storage. Electrical energy storage is considered to be a key component of the smart grid, among other things as a basic requirement for coping with electrical outages caused by disasters. In addition the smart grid is likely to use, and possibly require, dispersed storage (e.g., batteries installed for local purposes). This in turn implies overall control of many dispersed small storage installations together in the grid.

3. Microgrids will be key to the smart energy use of communities, factories, buildings, etc. Small-scale electrical energy storage is imperative for microgrids to achieve fair and economic consumption of electrical energy. To optimize cost efficiency, microgrids also require that their electrical energy storagebe connected to the grid and be able to adjust smoothly to increases and decreases in the amount of electrical energy consumed. Dispersed facilities, whether generation or storage (e.g., the electrical energy storage in a smart house or an electric vehicle), are normally owned by end users, who have in principle the right to decide how to use the facilities. This implies a differentiated policy and regulatory regime, with conditions applying to centralized facilities distinguished from those applying to dispersed ones.

Conclusions regarding markets

1. The total electrical energy storage market is expected to be large, but will remain very sensitive to cost. This has very specific implications on what R&D and policy goals are recommended. It also means that whether the relevant standards (e.g., to reduce costs by creating or enlarging homogeneous markets) are available at the right moment will have a great influence.

2. Some of the total market will be for conventional large-scale electrical energy storage to enable the introduction of renewable energies. The need for extremely large (GWh and TWh-scale) facilities will increase; in some applications they will need to be operated like conventional generators.

3. Long-term energy storage will be needed when a very high renewable energy ratio is achieved, which, since the storage period is up to several months, implies very large storage amounts. A possible solution: the new electrical energy storage technologies hydrogen and synthetic natural gas. Developing them involves chemical research and engineering, which are beyond the traditional scope of work of the IEC; this gives rise to certain recommendations.

4. The market for small and dispersed electrical energy storage is also expected to be quite large with the rollout of the smart grid and microgrids, implying storage installed at customer sites. Electrical energy storage will be used not only for single applications but simultaneously for several, made possible by integrating multiple dispersed storage sites.

Conclusions regarding technologies and deployment

1. To assure the smooth connection of electrical energy storage to grids, additional technical requirements and the necessary regulatory frameworks need to be investigated. As the renewable energy market grows, the market for electrical energy storage systems, especially for small and dispersed ones, will also expand and require technical specifications and regulation frameworks for grid interconnection of electrical energy storage. The aspects of interconnecting dispersed generation including renewable energy have been investigated. However, issues such as power quality and safety in connecting large numbers of electrical energy storage installations, mostly together with renewable energy, have not yet been thoroughly researched.

2. Given the cost sensitivity, cost reduction is vital to implementation. For this, lifetime cost should be considered, not simply installation cost but also cost of operation and disposal. Low raw material cost, a part of total installation cost, may become a specific selection criterion for electrical energy storage technology. In addition, interoperability among the various very different parts of the whole grid must be ensured, and sophisticated control intelligence is also essential for availability and overall efficiency. Successful deployment in any one country may further depend on the size and health of an indigenous “electrical energy storage supply industry,” which can help to control costs and ensure availability.

3. Three storage technologies seem to emerge from the study as the most significant. In order of decreasing technological maturity, they are

• pumped hydroelectricity (PHS)

• electrochemical batteries

• hydrogen/synthetic natural gas

The last two both in different ways need more development than PHS. Batteries require development primarily to decrease cost, and for some technologies to increase energy density as well; hydrogen/SNG must be further researched and developed across a broad front, including physical facilities, interactions with existing uses of gas, optimal chemical processes, safety, reliability and efficiency.

This, finally, leads to the actions themselves, i.e., to recommendations. It will be seen in Part 2 that recommendations fall into groups addressed to three different audiences: policy-makers including regulators, companies and laboratories deciding what research and product development to pursue, and the IEC itself for what standards will be needed by all EES market players.

* Read the entire document: www.iec.ch/whitepaper/pdf/iecWP-energystorage-LR-en.pdf.

![Guide to the Canadian Electrical Code, Part 1[i] – A Road Map: 26 the Edition, Section 36 – High Voltage Installations](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)