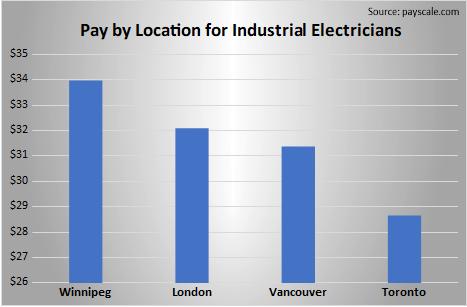

Q1 2015 Non-Residential Building Construction: Investment Down 1.2%

Following three consecutive quarters of growth, investment in non-residential building construction decreased 1.2% to $12.9 billion in the first quarter. This decline was largely the result of lower spending on the construction of commercial buildings (-1.9%).

Chart 1: Investment in non-residential building construction

Overall, investment decreased in eight provinces in the first quarter. The largest decline was in Ontario, where investment fell 2.0% to $4.9 billion as a result of lower spending on commercial buildings.

Alberta and British Columbia were the only provinces to register gains. In Alberta, the gain was due to increases in the institutional and industrial components, while in British Columbia, it resulted from higher spending on institutional buildings.

Census metropolitan areas

Investment was down in 20 of the 34 census metropolitan areas in the first quarter. The largest decline occurred in Ottawa, followed by Saskatoon. In Ottawa, the decrease was attributable to commercial spending, while the decline in Saskatoon came largely from lower spending in commercial and institutional buildings.

Conversely, the largest advances were reported in Edmonton and Vancouver. In Edmonton, the increase resulted from higher investment in the construction of institutional and commercial buildings, while in Vancouver investment advanced in all three components, mainly institutional buildings.

Commercial component

Investment in the commercial component declined 1.9% to $7.7 billion. This was the second consecutive quarterly decrease in the component and was mainly the result of lower spending on the construction of retail and wholesale outlets and recreational buildings.

Ontario posted the largest decrease, as investment fell 4.0% to $2.9 billion, the third consecutive quarterly decline. The decrease was mainly attributable to lower spending on the construction of retail and wholesale outlets, recreational buildings and warehouses.

Quebec and Newfoundland and Labrador posted increases, as a result of higher spending spread among several commercial building categories.

Chart 2: Commercial, institutional and industrial components

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 34](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i] – A Road Map: 26 the Edition, Section 36 – High Voltage Installations](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)