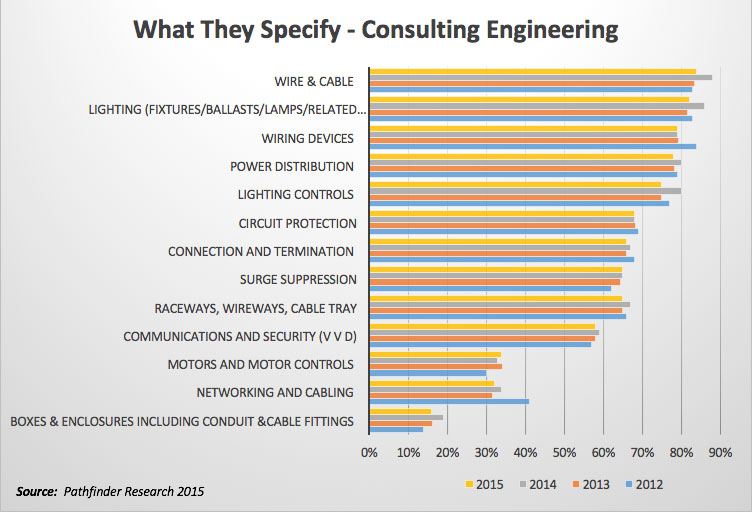

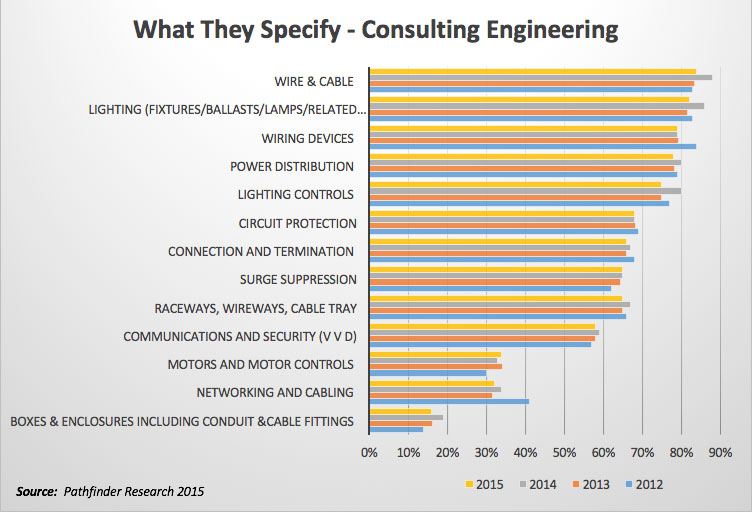

What Consulting Engineers Specify

Jan 07 2016

Wire and cable, lighting, and wiring devices top the list.

Jan 07 2016

Wire and cable, lighting, and wiring devices top the list.

The Canadian Electrical Code, Part I is a key component of Canada’s electrical safety system. Its value comes from its ability to facilitate innovation and create economic opportunities while helping to ensure public and worker safety. Although the code is updated every three years to reflect advances in technology and other major developments, the frequency of these updates and the sheer number of changes in each edition can make it challenging for you to keep up on the job. Choosing the right training program helps you to quickly understand the new requirements so you can unlock the value of the code.

Energy Efficient Lighting is a LED lighting manufacturer with nearly 30 years of industry experience. One that was founded on principles of environmental sustainability and responsibility to future generations.

This discussion of Appendix J -Annex J20 is based on the 24th edition. The Code is a comprehensive document. Sometimes it can seem quite daunting to quickly find the information you need.

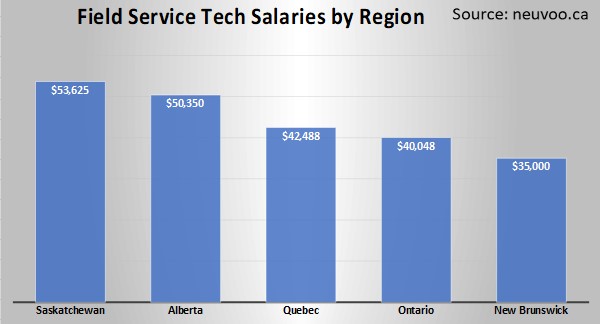

The average field service technician’s salary in Canada is $40,047 per year or $20.54 per hour. Entry level positions start at $18,200 per year. Most experienced workers make up to $68,079 per year.

It’s been a long time coming, but good news is here! IEEE 802.3bt — the 100W Power over Ethernet (PoE) standard — has been ratified and approved as a new standard.

January 3, 2025 Message from EFC President and CEO Carol McGlogan With 2024 coming to a close, we are taking a moment to reflect on the achievements and challenges of the past year. Navigating the dynamic and evolving landscape of our industry, we are proud of the incredible progress our organization has shown over the… Read More…

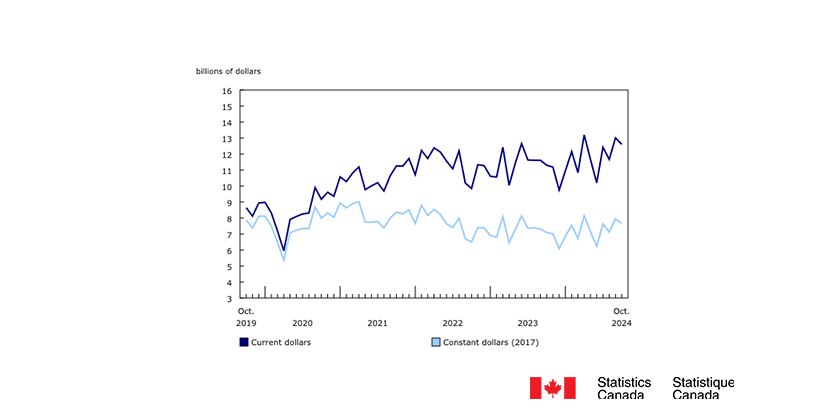

December 16, 2024 The total value of building permits issued in Canada decreased by $399.1 million (-3.1%) to $12.6 billion in October. This comes on the heels of a strong September, during which construction intentions rose by $1.3 billion to the second-highest level in the series. Despite the monthly decline in October, the total value of building permits… Read More…

By Matthew Biswas Do your eyes roll when you hear terms like Smart home technology? Or are you a true believer? As it turns out controlling electrical devices via low-voltage technology can be easier to implement and use than many of us thought. The Lutron Caseta system uses the internet and Radio Frequency to instantly… Read More…

December 16, 2024 Technical Advisor Trevor Tremblay explains why following best practices and relying on licensed professionals will ensure a smooth and secure transition when integrating this exciting new technology. Energy Storage Systems (ESS) are revolutionizing the way individuals and businesses manage energy, providing cost-saving opportunities, increased energy reliability, and a pathway toward sustainability. In… Read More…

January 3, 2025 The Government of Canada and the Government of Yukon are partnering to help Yukoners switch to smart electric heating systems, making life more affordable while reducing greenhouse gas emissions. The federal investment consists of $1.4 million from the Federal Oil to Heat Pump Affordability program (OHPA) and $287,000 from Canada’s Low Carbon… Read More…

January 3, 2025 IPEX is proud to announce it has been named to the prestigious Greater Toronto Top 100 Employer list by Mediacorp. Canada Inc. As part of the designation, IPEX was profiled in a special digital magazine, which can be found here and also on the Globe and Mail’s website. “We are honoured to receive this noteworthy award,” said… Read More…

January 3, 2025 The Manitoba government is bringing in a permanent 10 per cent cut to the provincial fuel tax, Premier Wab Kinew announced today. “Our government keeps our word. We said we’d cut the fuel tax and we did,” said Kinew. “We said it would last 12 months and it did. Now we’re going… Read More…

January 3, 2025 Starting Jan. 1, 2025, the B.C. home-flipping tax will be in place to discourage investors from buying housing to turn a quick profit. People who sell their home within two years of buying will be subject to the tax, unless they qualify for an exemption, such as divorce, job loss or change… Read More…

This project is funded [in part] by the Government of Canada.

Ce projet est financé [en partie] par le gouvernement du Canada.