Survey Documents Cost to Contractors of Payment Delays

June 20, 2018

Although slow payments are part of business as usual within the commercial construction industry, they are more pervasive and more costly than expected, according to results of a survey of U.S. construction subcontractors. This has cost consequences for the entire industry.

Subcontractors perform most construction activities, but slow payment cycles can hamper these small businesses from meeting payment obligations, such as payroll and material purchases. The cash flow cycle results in significant financing costs as well as liens placed against properties to ensure payment, notes Contract Simply, an automated workflow solutions provider that conducted the survey in partnership with Building Connected.

The purpose of the survey was to better understand how slow payments affect development project costs, risks and project completion. It distributed the survey to 1,300 contractors representing a wide diversity of construction trades. The survey’s findings indicate that slow payments in the industry result in US$40 billion in superfluous costs annually.

The survey results also revealed that

• 41% of subcontractors wait between 30 and 60 days for payment

• an additional 46% of those surveyed wait 60 to 90 day, confirming a PWC Working Capital report that engineering and construction sectors in the U.S. suffer from over 50 days sales outstanding (DSO).

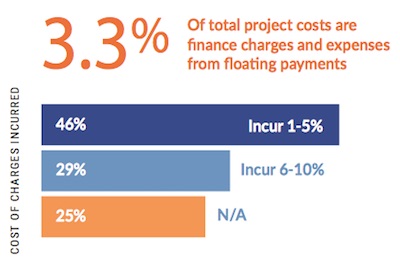

• 83% of the contractors surveyed have been forced to file a lien due to slow payment, with a majority reporting having used business savings or a line of credit to float payments to others. For 75% of the contractors, this means incremental costs in the form of finance fees and administrative time averaging 3.3% of the total project costs, which equates to $40 billion for the industry as a whole.

• more than 70% of respondents indicated that if construction lenders and borrowers were to offer net 30 payments, they would collectively be willing to provide US$21 billion in discounts.

Since many contractors build financing fees into proposals, faster payments could avoid costly and time-consuming liens and lower project costs. Paying promptly also enables developers and builders to attract and retain the best subcontractors in a competitive labour market.

The study makes four recommendations for expediting payments:

• implement digital solutions to track and expedite payments and cut days from invoice processing

• offer e-payments options

• collect lien releases digitally with payments to eliminate friction

• automate invoice approval workflows with daily reminders

Find out more: https://cdn2.hubspot.net/hubfs/2886905/Contract Simply Construction Payments Report 2018 Final.pdf

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)