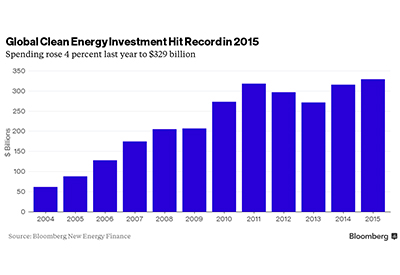

Renewable Energy Attracts Record US$329 Billion in Investments as Oil Slides

Jan 22, 2016

While oil prices have fallen two-thirds in 18 months, and with them jobs and capital spending, a record US$329.3 renewable energy was invested in renewable energy, according to research conducted by Bloomberg New Energy Finance. Contributing factors for the investment: falling prices for photovoltaics and wind turbines, and financing deals for major offshore wind projects.

In an article for Bloomberg Business, Jessica Shankleman notes that renewables are enjoying a renaissance underpinned by rules designed to curb fossil-fuel emissions damaging the atmosphere. Meanwhile, fears of low oil prices continuing into 2016 have delayed US$380 billion of investments in upstream projects.

New wind and solar power accounted for about half of all new generation last year. Around 64 gigawatts of new wind power and 57 gigawatts of new photovoltaics were added, representing an increase of 30% from to 2014.

China remained the biggest market for renewables last year, increasing investment 17% to US$110.5 billion, twice as much as the U.S., the second largest market. Investment was driven mainly by large-scale projects, including a number of major offshore wind farms. Another global winner: rooftop solar installations, increasing 12% to US$67.4 billion.

Read the full article: www.bloomberg.com/news/articles/2016-01-14/renewables-drew-record-329-billion-in-year-oil-prices-crashed.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)