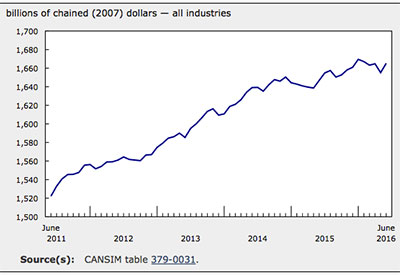

GDP Rises 0.6% in June

September 01 2016

Real gross domestic product (GDP) rose 0.6% in June, essentially offsetting an equivalent decline in May. Mining, quarrying and oil and gas extraction, manufacturing and utilities were the major contributors to the increase.

Goods-producing industries increased 1.6% in June. Mining, quarrying and oil and gas extraction contributed the most to the gain, mainly because of a rise in non-conventional oil extraction, as capacity gradually returned following the Fort McMurray wildfire and evacuation in May. Manufacturing and utilities also rose, while construction and the agriculture and forestry sector decreased.

The output of service-producing industries grew for a ninth consecutive month, rising 0.2% in June. Gains were posted by the public sector (education, health and public administration combined), transportation and warehousing services, and the finance and insurance sector. Retail trade recorded the most notable decline in output.

The mining, quarrying, and oil and gas extraction sector rises

Following four monthly declines, mining, quarrying and oil and gas extraction rose 3.6% in June. The increase was primarily due to a 12% gain in non-conventional oil extraction, as capacity gradually returned following the Fort McMurray wildfire and evacuation in May. Despite the increase, the industry’s output in June remained well below the average of the last three years.

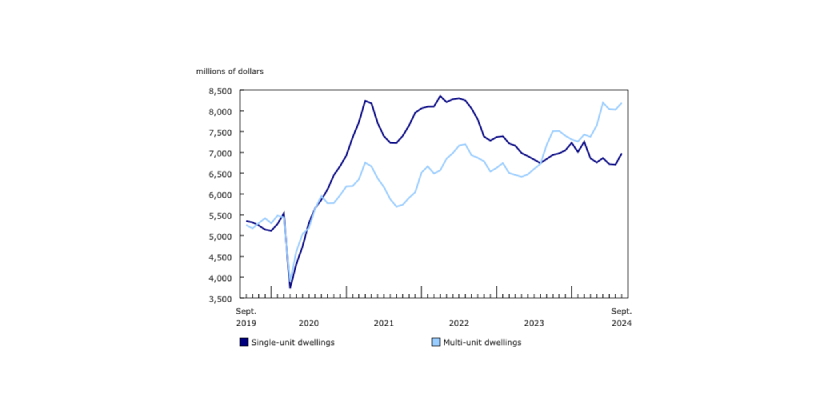

Chart 2: Non-conventional oil extraction partially rebounds in June

Conventional oil and gas extraction increased for a third consecutive month, up 0.3% in June.

Mining excluding oil and gas extraction rose 2.5% in June, a third consecutive monthly gain. The main contributor was an increase in metal ore mining (+3.4%), notably in copper, nickel, lead and zinc mines, which supported a rise in exports of metal ores and concentrates.

Support activities for mining and oil and gas extraction were down for a fifth month in a row, declining 2.0% in June. There was lower output from drilling services for oil and support activities for mining.

Manufacturing output grows

Manufacturing output grew 1.8% in June. This gain offset the decline in durable goods manufacturing and partially moderated the decrease in non-durable manufacturing in May.

Durable-goods manufacturing rose 2.4%, with all industry subsectors posting increases. The main contribution came from a 2.9% gain in manufacturing of transportation equipment, as the volume of sales increased in the motor vehicle parts and motor vehicle assembly industries.

Non-durable goods manufacturing increased 1.0%. The petroleum and coal products subsector rose 6.0%, as production resumed at facilities that had maintenance and turnaround work in May and the supply of crude petroleum feedstock to petroleum refineries from facilities affected by the Fort McMurray wildfire and evacuation increased. Food manufacturing declined 1.6%, as most industries in the sector reported lower output.

Utilities increase

Utilities increased 3.1% in June as both electric power generation, transmission and distribution, and natural gas distribution rose. Demand for electricity was higher as a result of warmer-than-usual temperatures in provinces east of Manitoba.

The public sector grows

The public sector (education, health and public administration combined) increased 0.2% in June. Health and education services rose, while public administration was unchanged. Federal public administration declined in June, following increased activity due to the 2016 Census in May.

Wholesale trade increases and retail trade declines

Wholesale trade increased for a fourth consecutive month, rising 0.4% in June. There were gains in the wholesaling of personal and household goods, building materials and supplies, machinery, equipment and supplies, and motor vehicle and parts. Food, beverage and tobacco wholesaling recorded the largest decline.

Retail trade fell 0.4% in June, led by decreases at food and beverage stores, clothing and clothing accessories stores, and general merchandise stores (which include department stores). Motor vehicle and parts dealers recorded their first increase in three months.

Construction declines

Construction declined for the third month in a row in June, down 0.4%. There were decreases in residential and non-residential building construction, as well as repair construction and engineering and other construction activities.

The real estate and rental and leasing sector increased 0.2% in June. The output of lessors of real estate rose 0.4%. Real estate agents and brokers (-0.9%) posted a second consecutive monthly decline, as home resale activity was down.

The finance and insurance sector rises

The finance and insurance sector rose 0.5% in June. Banking and financial investment services increased.

Other industries

Transportation and warehousing services rose 0.9% in June. Air transportation increased 1.9% on the strength of both goods and passenger transportation. Following three consecutive monthly declines, rail transportation grew 2.2%, partly as a result of an increase in the movements of automotive products and petroleum and chemical products. Trucking services were up 1.2%.

Professional, scientific and technical services edged down 0.1% in June. Architectural, engineering and related services fell in June, continuing a downward trend that began in the fall of 2014.

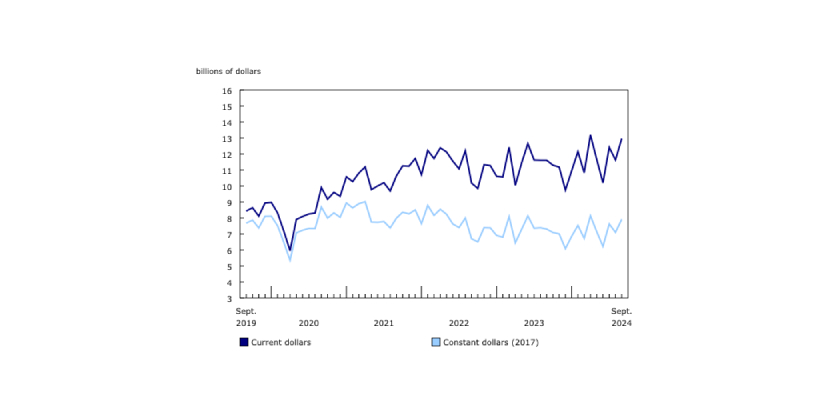

Chart 3: Main industrial sectors’ contribution

Second quarter of 2016

The value added of goods-producing industries decreased 2.2% in the second quarter, the largest quarterly decline since the second quarter of 2009. The value added of service industries rose 0.5% in the second quarter.

The decline in the value added of goods-producing industries was mainly led by a large drop in non-conventional oil extraction (-18%). Most of the decline was attributable to two factors that lowered output for this industry. The most significant factor was the Fort McMurray wildfire and evacuation, which led to lower production in May and early June. The other factor was maintenance shutdowns at upgrader facilities, which affected output in April. Excluding the decline in the non-conventional oil extraction industry, real GDP by industry edged up 0.1% in the second quarter.

In other industries of the mining, quarrying and oil and gas extraction sector, conventional oil and gas extraction rose 1.2%, while mining and quarrying (except oil and gas extraction) was down 1.5%. Support activities for mining and oil and gas extraction declined for a third consecutive quarter.

Following three consecutive quarterly increases, manufacturing output declined 1.2% in the second quarter, the largest drop since the fourth quarter of 2012. Non-durable manufacturing edged down, while most subsectors in durable goods manufacturing declined. Construction (-0.7%) fell for the sixth consecutive quarter, with all components recording decreases. The agriculture and forestry sector was also down.

The finance and insurance sector grew 1.2% in the second quarter, as a result of gains in banking and financial investment services and a rise in the insurance sector, which was partly due to an increase in claims related to the Fort McMurray wildfire. The public sector (education, health and public administration combined) rose 0.7%, mainly because of gains in public administration due to the 2016 Census. Wholesale trade and real estate and rental and leasing also increased in the second quarter, while retail trade edged down.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/160831/dq160831b-eng.htm?HPA=1.