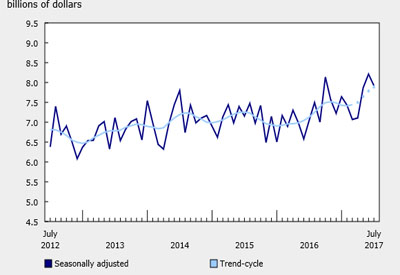

Value of Building Permits Issued in July Declines 3.5%

September 13, 2017

Canadian municipalities issued $7.9 billion worth of building permits in July, down 3.5% from June and the first decrease since March 2017. Lower construction intentions for commercial buildings and multi-family dwellings were mainly responsible for the national decline.

The total value of permits was down in seven provinces, led by lower construction intentions for multi-family dwellings and commercial buildings in Ontario.

The census metropolitan area (CMA) of Toronto posted the largest municipal decrease, as the total value of building permits fell 16.2% in July to $1.5 billion. The decline followed two consecutive monthly increases and was mainly attributable to lower construction intentions for multi-family dwellings.

In the rest of Ontario the total value of buildings permits fell 3.7% to $3.3 billion, the first decline since April 2017. The decrease was mainly attributable to lower construction intentions in the residential sector, specifically multi-family dwellings, which fell 20.5% to $849.7 million. The decline in the value of multi-family dwelling permits followed three consecutive monthly increases. In contrast, the value of permits for single-family dwellings rose 7.9% to $1.1 billion in Ontario. Overall, the value of residential permits was up 4.2% compared with the same month in 2016.

The value of multi-family dwellings in British Columbia rose 14.2% from June to $771.8 million in July, the highest value on record. The increase was mainly attributable to higher construction intentions for apartments in the Vancouver CMA. Municipalities in this CMA issued $562.2 million in permits for multi-family dwellings, up 17.4% from June and the highest value on record.

Residential sector: decline in multi-family component

Canadian municipalities issued $5.0 billion worth of residential building permits in July, down 2.2% from June and the first decline since April 2017. Lower construction intentions for multi-family dwellings more than offset a moderate gain in the single-family component. The residential sector was down in six provinces in July, with Ontario posting the largest drop.

Construction intentions for multi-family dwellings fell 7.4% in July to $2.5 billion, the first decline since March 2017. The value of multi-family dwelling permits was down in eight provinces in July on lower construction intentions for row houses in Ontario, specifically the Toronto CMA. Conversely, single-family dwelling construction intentions rose 3.6% in July to $2.5 billion, largely attributable to gains in five provinces, led by Ontario. The increase followed an 11.7% drop in June.

In July, Canadian municipalities approved the construction of 13,830 multi-family units (down 4.2% from June) and 5,754 single units (up 4.6% from June).

Non-residential sector: commercial component down after two consecutive monthly increases

The value of building permits issued for non-residential structures fell 5.7% in July to $2.9 billion, the first decrease since February 2017. The decline was largely attributable to lower construction intentions for commercial buildings.

The commercial component fell 14.7% in July to $1.5 billion, following two consecutive monthly increases (+15.6% in May and +13.7% in June). The decline was mainly attributable to lower construction intentions for office buildings. Every province except for Newfoundland and Labrador posted declines in the value of commercial building permits.

The value of building permits issued for industrial structures fell 4.0% to $558.0 million in July, following a 7.8% gain in June. The decline primarily stemmed from lower construction intentions for maintenance buildings and transportation terminals.

In contrast, the value of permits for institutional structures rose 11.9%, to $903.4 million, the second consecutive monthly increase and the highest value since October 2015. The gain was mainly due to higher construction intentions for hospitals.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/170907/dq170907a-eng.htm