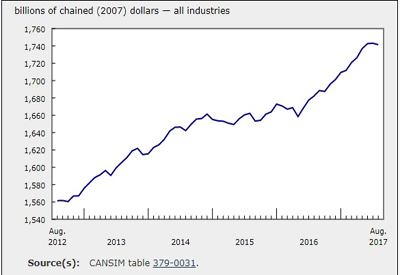

GDP Slips 0.1% in August 2017

Nov 12, 2017

Real gross domestic product (GDP) edged down 0.1% in August, after being essentially unchanged in July. Declines in manufacturing and mining, quarrying and oil and gas extraction more than offset increases in most sectors (12 out of 20).

Goods-producing industries contracted for the second consecutive month, declining 0.7% in August in part due to temporary reduced capacity in the manufacturing and the mining, quarrying and oil and gas extraction sectors. Services-producing industries edged up 0.1%. Building materials and supplies (-2.8%) and machinery, equipment and supplies wholesaling (-0.7%) gave back some of the gains registered in July.

The manufacturing sector declines

Following a 0.2% dip in July, the manufacturing sector contracted 1.0% in August as both durable and non-durable manufacturing declined.

Non-durable manufacturing decreased 2.0% following three consecutive months of growth as the majority of subsectors registered declines. Chemical manufacturing dropped 7.3%, its largest decline in the last 20 years, as all industry groups declined. Declines reflected in part some lost capacity due to plant maintenance shutdowns and lower demand from export markets for basic chemicals and pharmaceutical and medicinal products. There were notable decreases in manufacturing of petroleum and coal products (-3.1%) and plastic and rubber products (-2.5%). Food (+1.2%) and beverage and tobacco product manufacturing (+3.4%) were the only non-durable subsectors to increase.

Durable manufacturing declined 0.1% as 6 of 10 subsectors contracted. Fabricated metal (-3.2%) and miscellaneous manufacturing (-6.6%) contributed the most to the decline. Increases in machinery (+5.8%), primary metal (+1.4%) and electrical equipment (+1.9%) manufacturing partly offset the declines in other subsectors.

The mining, quarrying, and oil and gas extraction sector contracts

The mining, quarrying, and oil and gas extraction sector was down 0.8% in August, declining for the third consecutive month.

The oil and gas extraction subsector contracted 1.4%, with conventional oil and gas extraction declining 5.2% as both crude petroleum and natural gas extraction declined. Maintenance shutdowns in Newfoundland and Labrador in August affected conventional oil production. Non-conventional oil extraction grew 3.3%, more than offsetting a 3.0% decline in July.

Mining and quarrying (except oil and gas) expanded 2.5% in August. Non-metallic mineral mining grew 8.6%, led by a 14% increase in potash mining. Coal mining was up 6.2%. Metal ore mining declined 1.9% as growth in copper, nickel, lead and zinc (+4.4%) and gold and silver ore mining (+1.7%) was more than offset by declines in iron ore (-11%) and other metal ore mining (-3.4%).

Support activities for mining, oil and gas extraction declined 2.8%. This was a fourth consecutive decline after a string of increases that began in the summer of 2016.

Wholesale trade grows while retail trade declines

After growing 2.0% in July, wholesale trade gained 0.4% in August as five of nine subsectors grew. Leading the growth was a 4.4% increase in personal and household goods wholesaling, which rose for the sixth month in a row. Miscellaneous (+1.5%), motor vehicle and parts (+1.3%) and petroleum products wholesaling (+2.3%) also increased. Building materials and supplies (-2.8%) and machinery, equipment and supplies wholesaling (-0.7%) gave back some of the gains registered in July.

The retail trade sector posted a 0.4% decrease as its 12 subsectors were evenly split between increases and decreases. The largest declines in terms of activity were at food and beverage stores (-2.0%) as most of the industry groups in the subsector registered decreases. There was less activity at store types traditionally associated with housing purchases and home renovation as both building material and garden equipment and supplies stores (-1.3%) and furniture and home furnishing stores (-2.3%) registered decreases. There were increases at clothing and clothing accessories stores (+1.3%), electronics and appliance stores (+2.0%) and motor vehicle and parts dealers (+0.4%).

Real estate rental and leasing edges up

Real estate and rental and leasing edged up 0.2% in August.

Following four consecutive months of decline, activity at the offices of real estate agents and brokers rose 0.3% in August, led by increases in the Greater Toronto and Greater Vancouver areas.

Finance and insurance edges up

The finance and insurance sector posted a gain of 0.2%, following a 0.6% decline in July, which was the largest in two years. Depository credit intermediation and monetary authorities grew 0.7% as activity at banking, monetary authorities and other depository credit intermediaries increased. Financial investment services, funds and other financial vehicles were down for a third consecutive month, declining 0.6%, while insurance carriers and related activities declined 0.2%.

Transportation and warehousing up slightly

Transportation and warehousing grew 0.2% as four of nine subsectors increased. Air transportation (+2.1%) rose for a third consecutive month as there was increased air traffic both from Canadian travellers and travellers to Canada from other countries. Postal service and couriers and messengers expanded 1.5% as both industries increased. Rail transportation contracted 1.8% as rail movement of automotive products, manufactured goods and intermodal freight declined. Pipeline transportation declined 0.6% as increases in pipeline transportation of natural gas (+0.7%) were more than offset by declines in crude oil and other pipeline transportation (-1.8%).

Construction edges down

The construction sector declined for a second consecutive month, edging down 0.1% in August. The declines in July and August have only given back part of June’s 1.8% increase. Residential construction declined 0.9% from decreases in work put in place on single-family dwellings. Growth in non-residential (+0.5%) and repair construction (+0.7%) was more than offset by the declines in residential and engineering and other construction activities (-0.1%).

Other industries

The utilities sector was down 0.8% as electric power generation, transmission and distribution as well as natural gas distribution declined. Cooler than usual weather in August reduced electricity demand for air conditioning.

Professional services grew 0.3%, mainly attributable to increases in computer systems and related services (+0.5%) and management, scientific and technical consulting services (+0.9%).

Accommodation and food services edged up 0.1%, as a 1.0% rise in accommodation services was almost entirely offset by a 0.2% decline at food services and drinking places.

The public sector (education, health care and public administration) was up 0.2%, rising for the seventh month in a row.

Agriculture, forestry, fishing and hunting (-0.3%) was down.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/171031/dq171031a-eng.htm

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)