Despite Overall Residential Decline, Single-Family Dwelling Permits Maintain Modest Growth for December

February 15, 2024

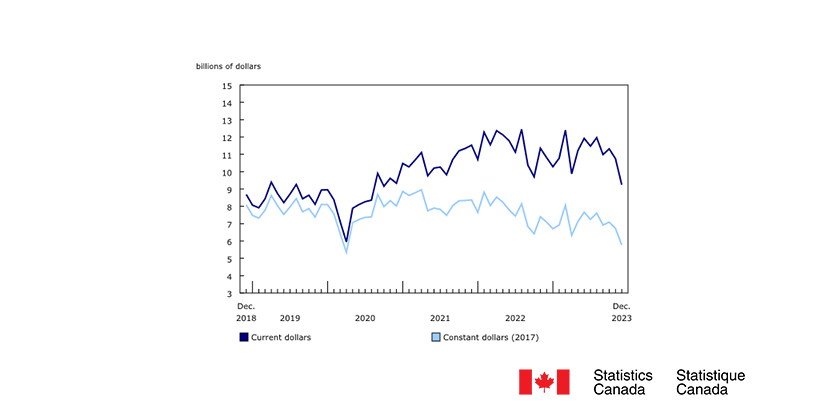

The total value of building permits in Canada decreased 14.0% from November to $9.2 billion in December, the lowest monthly level since October 2020. Declines were recorded in both the residential and non-residential sectors.

On a constant dollar basis (2017=100), the total value of building permits declined 14.2% to $5.8 billion in December.

Despite overall residential decline, single-family dwelling permits maintain modest growth

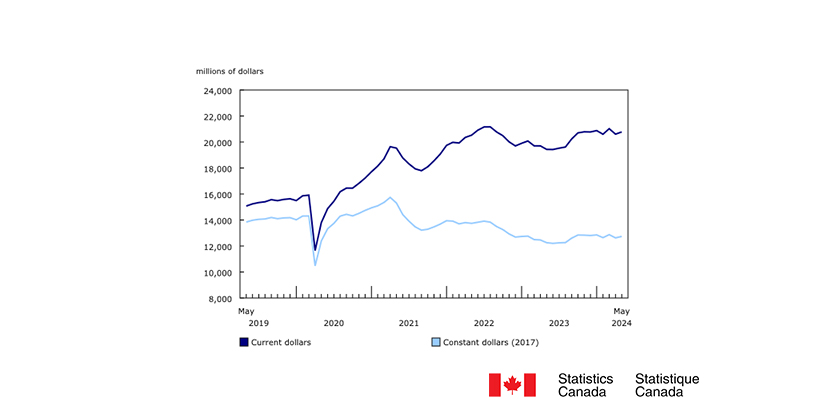

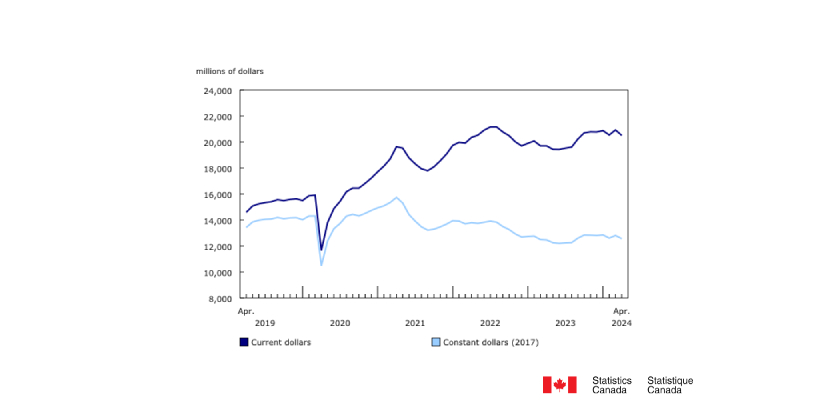

The total value of residential permits fell 17.9% to $5.7 billion in December, driven by a significant decline in multi-unit construction intentions (-31.1%; -$1.3 billion), the largest monthly drop in the series.

The decline in value of multi-unit permits in Ontario (-45.2%; -$816.8 million) greatly contributed to the overall monthly decrease in the residential sector in December.

Meanwhile, construction intentions in single-family dwellings edged up 0.8% to $2.9 billion in December. The gain in Alberta (+15.3%; +$84.4 million) more than offset declines in seven provinces as construction intentions for Albertan single-family dwellings recorded a fifth consecutive monthly increase and the largest monthly value since January 2014.

Decline in new major institutional construction intentions pushes down non-residential sector

The total value of non-residential sector permits decreased 7.0% to $3.6 billion in December. The institutional decline in Quebec (-55.8%; -$313.9 million) more than offset total gains in the commercial (+4.1%; +$69.1 million) and industrial (+4.7%; +$39.3 million) components across Canada. Quebec’s large monthly decline is attributed to the absence of new major institutional permits issued in December, after two projects estimated at over $150 million each were issued in November.

Fourth quarter of 2023 records weakest quarterly aggregates since the third quarter of 2021

The total value of building permits in the fourth quarter of 2023 was $31.3 billion, down 9.0% from the previous quarter, and down 1.7% from the fourth quarter of 2022. The total value of building permits in the fourth quarter of 2023 was the lowest quarterly level reported since the third quarter of 2021 ($30.8 billion).

Both non-residential (-13.3% to $11.6 billion) and residential (-6.3% to $19.7 billion) building permit values decreased from the third quarter to the fourth quarter of 2023.

The single-family dwellings component was the only component to post a quarterly increase (+1.4% to $8.5 billion) in the fourth quarter, building on an increase of 9.8% in the third quarter. Similarly, there was a 2.9% increase in dwelling units authorized for single-family dwellings across Canada in the fourth quarter.

Most notably, the value of permits for single-family dwellings in Alberta grew 23.4% to $1.7 billion in the fourth quarter, marking the third quarterly increase in a row. The fourth quarter also marked the third consecutive quarterly increase in new dwelling units issued for the province, up 21.9% to 4,000 new units.

Annual review of 2023: Record high in institutional construction intentions largely due to investments in hospitals and long-term care facilities

Year over year, the total current dollar value of building permits fell 3.2% to $132.2 billion in 2023. However, rising material and labour costs inflated nominal building permit valuations. On a constant dollar basis (2017=100), the total annual value of building permits decreased 8.9% from 2022 to $84.2 billion in 2023.

The remainder of this article will be presented in constant dollars (2017=100) to focus on real permit value changes over time.

The residential sector experienced its second consecutive annual decline in building permit values, declining by 15.5% to $48.3 billion in 2023, while the non-residential sector rose for the third consecutive year, up 1.7% to $35.9 billion in 2023. The institutional (+14.4%; +$1.4 billion) and industrial (+4.1%; +$290.8 million) components experienced series highs in construction intentions, leading to an overall growth increase in the non-residential sector. However, growth in the non-residential sector was tempered by the decline in the commercial component (-6.1%; -$1.1 billion), which accounted for almost half of the value of construction intentions in the non-residential sector.

The gains in the institutional component were mostly attributed to large construction intentions for hospitals and long-term care facilities. The demand on the Canadian healthcare system has been magnified in recent years due to the COVID-19 pandemic and Canada’s aging population. A variety of public policies have been announced to address the high demands on the healthcare system, including investments from various levels of government like the federal Canada Health Transfer top-ups, and bilateral agreements between governments. In 2023, the largest building permit issued was for a new hospital in Vaudreuil-Dorion (Quebec), with an estimated construction value of almost $1.0 billion. Construction intentions for hospital permits that cost over $100.0 million were recorded in Montréal and the Greater Toronto Area, as well as throughout British Columbia, specifically in Dawson Creek, North Cowichan, Williams Lake and the Greater Vancouver Area.

Building permits for long-term care facilities also bolstered growth in the institutional component, with large construction intentions concentrated in Ontario, Quebec and Nova Scotia. The institutional component in Nova Scotia (+197.0%; +$146.8 million) recorded its highest-ever yearly increase in 2023, with approximately three-quarters of institutional construction intentions tied to senior living spaces and specifically long-term care facilities, aligning with the Government of Nova Scotia’s goal of expanding the availability of long-term care in the province.