Multi-Unit Component Drives Residential Sector Construction Investment in December 2024

February 14, 2025

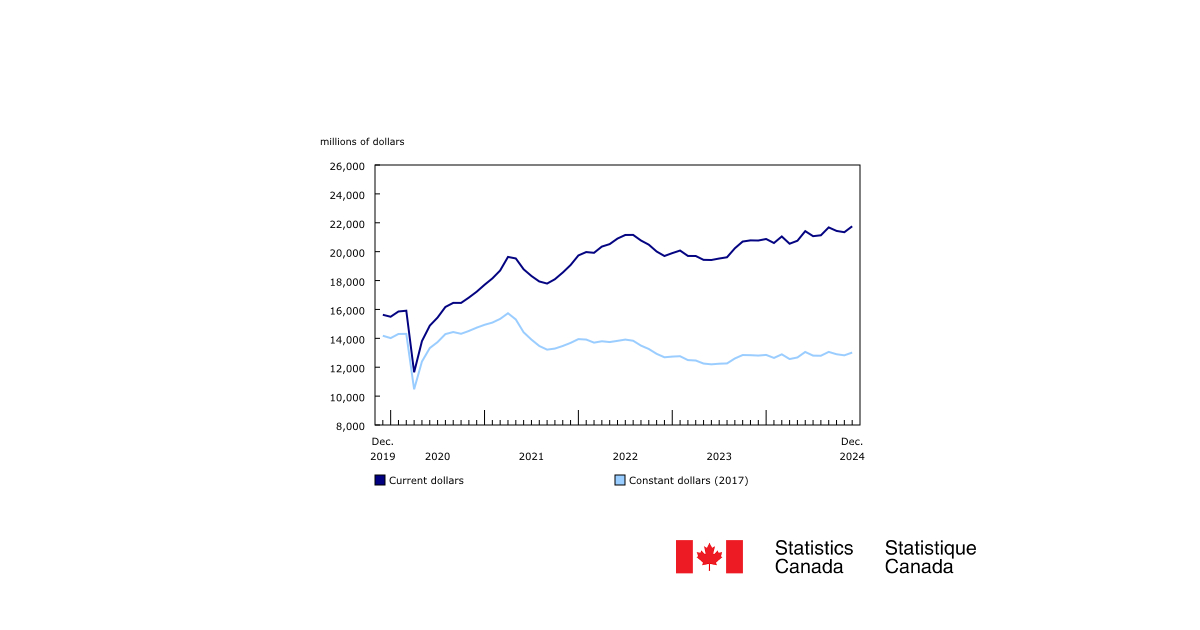

Overall, investment in building construction rose 1.9% (+$408.1 million) to $21.8 billion in December, with gains recorded across all components. The residential sector grew 2.2% to $15.1 billion while the non-residential sector was up 1.3% to $6.7 billion. Year over year, investment in building construction grew 4.7% in December.

On a constant dollar basis (2017=100), investment in building construction increased 1.5% from the previous month to $13.0 billion in December and was up 1.6% year over year.

Multi-unit component drives residential sector gains in December

Investment in residential building construction was up 2.2% (+$323.9 million) to $15.1 billion in December.

Single family home investment edged up 0.8% (+$60.7 million) to $7.3 billion in December, marking its fifth consecutive monthly increase.

Investment in multi-unit construction rose 3.5% (+$263.2 million) to $7.7 billion in December, rebounding from two significant and consecutive monthly declines.

Ontario leads growth in non-residential investment

Investment in non-residential construction increased 1.3% (+$84.1 million) to $6.7 billion in December. Monthly increases were recorded in eight provinces and one territory, with Ontario (+$54.3 million) leading the growth and marking its 10th straight monthly increase.

The industrial component was up 1.8% (+$26.2 million) to $1.5 billion in December. Quebec (+$15.9 million) led the growth, followed by six other provinces and two territories.

Commercial construction investment edged up 0.6% (+$20.2 million) to $3.3 billion in December. Gains in Ontario (+$24.9 million) were tempered by decreases in Alberta (-$10.6 million) and British Columbia (-$3.3 million).

In December, institutional construction investment rose 2.0% (+$37.7 million) to $1.9 billion with seven provinces and the three territories recording increases. Quebec (-$12.5 million) drove the monthly declines across the remaining three provinces.

Fourth quarter summary

Investment in building construction grew 1.0% (+$654.1 million) to $64.5 billion in the fourth quarter, marking the sixth consecutive quarterly increase.

The quarterly increase in investment in building construction in the fourth quarter was primarily led by the non-residential sector (+$580.7 million to $19.8 billion), which accounted for 88.9% of the total growth in the quarter. The institutional (+$244.8 million to $5.7 billion) and industrial (+$224.6 million to $4.3 billion) components drove the increase in the non-residential sector, while the commercial component (+$111.3 million to $9.8 billion) contributed less to the increase.

Investment in the residential sector edged up 0.2% to $44.8 billion in the fourth quarter. Growth in single family home investment (+$1.3 billion to $21.7 billion) was almost entirely offset by declines in the multi-unit component (-$1.2 billion to $23.1 billion).

Annual summary for 2024

Year over year, investment in building construction rose 5.8% to $253.8 billion in 2024. On a constant dollar basis (2017=100), the total value of investment in building construction increased 2.4% to $154.1 billion for the year. Despite these gains, the total value of investment in building construction in constant dollars remained below the record high level reached in 2021 ($171.9 billion).

The remainder of this release will use constant dollars (2017=100) to highlight real annual changes in the investment in building construction value.

Residential sector investment rose 3.0% to $102.4 billion in 2024, driven by the multi-dwelling component (+9.3% to $54.6 billion) following two consecutive annual decreases. Meanwhile, investment in single family homes decreased 3.3% to $47.8 billion, marking the lowest level on record for the series.

Investment in the non-residential sector increased 1.1% to $51.7 billion in 2024.

The industrial component was up 4.4% (+$440.7 million) to $10.5 billion, reaching a record high in 2024. Gains were observed in six provinces and two territories, led by Ontario (+$397.6 million) and Alberta (+$228.5 million).

Institutional construction investment rose 9.7% (+$1.3 billion) to $15.3 billion in 2024, marking the fifth consecutive annual growth. Ontario (+$930.1 million) saw the largest gain, followed by British Columbia (+$356.6 million) and five other provinces.

Investment in the commercial component tempered the gains in the industrial and institutional components, decreasing 4.5% (-$1.2 billion) to $25.9 billion in 2024.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)