Multi-Unit Permits Drive Residential Sector Growth in December 2024 Building Permits

February 14, 2025

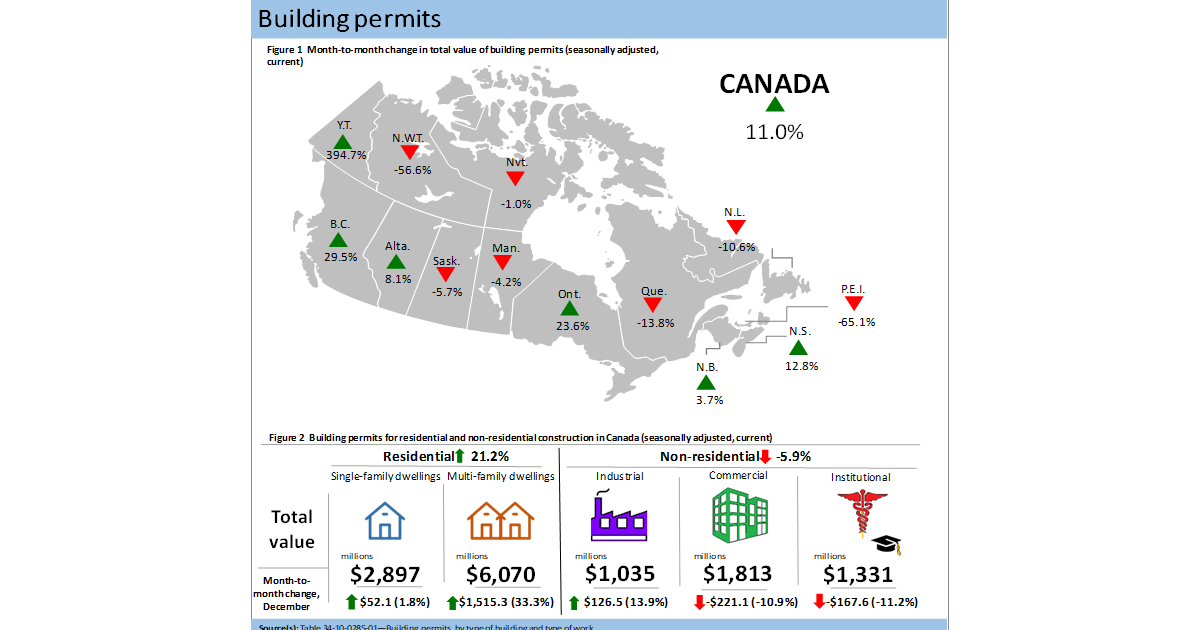

The total value of building permits rose 11.0% to $13.1 billion in December. The increase was led by a 21.2% increase in the residential sector, largely due to gains in Ontario and British Columbia.

On a constant dollar basis (2017=100), the total value of building permits issued in December grew 8.8% from the previous month and was up 30.5% on a year-over-year basis.

Multi-unit permits drive residential sector growth

The total value of residential permits increased by $1.6 billion to $9.0 billion in December. Multi-unit construction intentions (+$1.5 billion) contributed the most to the gain, posting a 33.3% increase from the previous month.

The increase in the total value of multi-unit permits in December was primarily attributable to gains in Ontario (+$985.5 million) and British Columbia (+$566.0 million).

Construction intentions for single-family homes were up 1.8% (+$52.1 million) to $2.9 billion in December, recording gains across six provinces and two territories. British Columbia (+$29.3 million) led the rise, followed by Ontario (+$28.5 million) and Manitoba (+$27.8 million).

Value of building permits for the single-family and multi-family components

Value of building permits for the residential and non-residential sectors

Quebec permits pull down the non-residential sector in December

The total value of non-residential permits fell 5.9% (-$262.2 million) to $4.2 billion in December, marking the third monthly decrease in a row. Declines in the commercial (-$221.1 million) and institutional (-$167.6 million) components more than offset a gain in the industrial component (+$126.5 million).

Monthly declines in non-residential construction intentions were recorded in seven provinces and one territory in December. Quebec (-$269.1 million) led the drop, as an increase in its institutional component (+$107.2 million) was more than offset by decreases in its industrial (-$278.8 million) and commercial (-$97.6 million) components.

In contrast, Ontario’s non-residential sector posted a $98.4 million gain in December, driven by its industrial component (+$315.8 million). Meanwhile, both Ontario’s institutional (-$181.9 million) and commercial (-$35.5 million) components decreased.

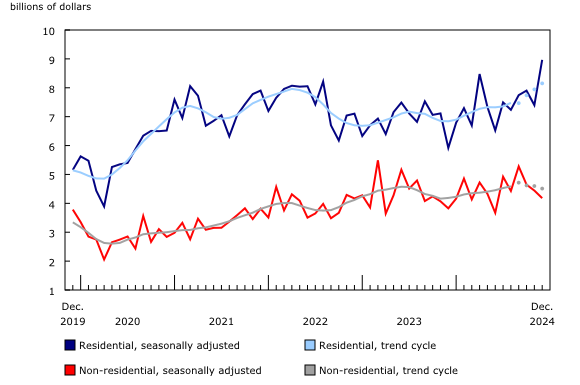

Quarterly review: growth in residential construction intentions leads to fourth consecutive quarterly increase

The total value of building permits in the fourth quarter edged up $430.8 million (+1.2%) to $37.5 billion, marking the fourth consecutive, albeit slowest, quarterly increase in 2024. In the fourth quarter, the residential sector led the growth, while the non-residential sector retreated after reaching a record high level in the third quarter.

Residential construction intentions grew by $1.8 billion (+8.0%) to $24.3 billion in the fourth quarter. Multi-family construction intentions (+$1.3 billion) contributed 70.1% of these gains, while the single-family component (+$535.3 million) accounted for 29.9%.

Ontario (+$1.0 billion) led the growth in multi-family construction intentions in the fourth quarter, supported by major projects in the Toronto census metropolitan area (+$997.8 million). In the single-family component, Alberta (+$218.4 million) and Ontario (+$172.5 million) led the growth, supported by six additional provinces and one territory.

The value of non-residential building permits declined by $1.4 billion (-9.3%) to $13.3 billion in the fourth quarter, after reaching a record high in the previous quarter. Ontario’s non-residential sector (-$1.1 billion) led the decline, despite reporting its second-highest level in the series, due to its industrial (-$824.0 million) and commercial (-$336.0 million) components.

Overall, Canada’s industrial (-$876.1 million) and commercial (-$635.0 million) components declined in the fourth quarter, while the institutional component (+$150.1 million) increased.

Annual review of 2024: single-family construction intentions temper the growth in multi-family and non-residential permit values

Year over year, the total value of building permits issued in Canada increased by $10.5 billion (+7.8%) to $145.3 billion in 2024, reaching its highest level since the start of the series in 2017. On a constant dollar basis (2017=100), the total value of building permits increased 3.7% in 2024, bringing it to the second-lowest annual level since 2017. The constant dollar growth reflects a declining trend in the real value of single-family building permits, which tempered the upward trend in real value of multi-family and non-residential permits.

The remainder of this release will use constant dollars (2017=100) to highlight real annualized changes in permit value over time.

The residential sector increased by $3.1 billion (+6.3%) to $52.5 billion in 2024, marking the second-lowest level in the series, following the record low of $49.3 billion in 2023. The relatively low level seen in 2024 is due to single-family construction intentions falling 30.9% (-$8.3 billion) from an average total value of $27.0 billion from 2017 to 2022 to an average of $18.6 billion from 2023 to 2024.

Conversely, the multi-family component increased by $3.7 billion (12.2%) to $34.1 billion in 2024, the second-highest level in the series.

Meanwhile, the number of units authorized for construction increased by 24,100 to 287,100 in 2024, the second-highest level in the series, driven by the growth of multi-family units (+22,900).

The total value of non-residential building permits issued experienced a fourth consecutive annual increase, rising by $59.5 million (+0.2%) to $36.6 billion in 2024, with Ontario (+$1.6 billion) leading the growth.

Commercial construction intentions (+$190.7 million) partially rebounded in 2024 after decreasing in 2023 to the second-lowest value on record. The industrial component (+$182.4 million) grew to a series high in 2024, after steadily regaining momentum following the sharp decline in 2020. In 2024, institutional permit values (-$313.6 million) declined but remained strong, sitting at the second-highest level in the series.

In 2024, as in 2023, gains in industrial construction intentions were driven by manufacturing, processing and assembly plants. Specifically, there was growth in permits to develop the battery plant supply chain in 2024, with notable projects being in St. Thomas, Ontario; Windsor, Ontario, and Bécancour, Quebec. Developing vehicle battery manufacturing has been supported by the federal and provincial (Ontario and Quebec) governments’ goals to build Canada’s electric vehicle supply chain.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)