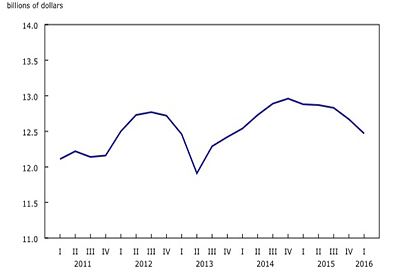

Q1 Investment in Non-Residential Building Construction Continues Decline

October 21, 2016

Investment in non-residential building construction declined for the fifth consecutive quarter, down 1.6% from the previous quarter to $12.5 billion in the first quarter. Nationally, the decrease resulted from lower spending in all three components, with commercial buildings accounting for most of the decline.

Non-residential building construction spending was down in eight provinces, with Alberta posting the largest decline and Quebec a distant second.

In Alberta, the decline came mainly from lower investment in commercial and industrial buildings, as spending on institutional buildings has been on an upward trend since the third quarter of 2014. In Quebec, lower spending on institutional and commercial buildings was responsible for the decrease.

British Columbia and Saskatchewan were the only two provinces to register advances. In British Columbia, the gain was a result of higher investment in commercial and industrial buildings. In Saskatchewan, the increase came from institutional structures and, to a lesser degree, commercial buildings.

Census metropolitan areas

Non-residential building construction spending fell in 22 of the 34 census metropolitan areas in the first quarter, led by Edmonton, followed by Montreal, Winnipeg and Calgary.

In Edmonton, the decrease was attributable to lower construction spending on commercial and industrial buildings. In Montreal, lower investment in institutional building construction was largely responsible for the decline.

The decline in Winnipeg resulted from lower spending on institutional and commercial buildings. In Calgary, the drop was attributable to decreased investment in commercial buildings, which was partly offset by higher investment in institutional buildings and, to a lesser extent, industrial buildings.

Conversely, the largest gains occurred in Saskatoon and Vancouver. In Saskatoon, the advance came largely from higher investment in the institutional component, while in Vancouver, the increase stemmed from all three components, with commercial buildings accounting for much of the gain.

Commercial component

Investment in commercial building construction fell 1.8% to $7.2 billion in the first quarter, marking a fifth consecutive quarterly drop. Investment was down in seven provinces, with declines spread across several commercial construction categories.

Alberta posted the largest decline, followed distantly by Quebec and Newfoundland and Labrador.

In Alberta, spending in commercial building construction was down 6.9% to $1.7 billion in the first quarter, marking the fourth consecutive quarterly decline. This was a result of lower investment in most commercial categories, particularly warehouses and office buildings.

In Quebec, investment fell 1.7% from the previous quarter to $1.1 billion in the first quarter, mainly attributable to lower spending on office buildings, communication buildings and warehouses.

In Newfoundland and Labrador, investment fell 21.0% to $69 million, a third quarterly decline. Lower spending on the construction of office buildings, hotels and restaurants, and warehouses was responsible for most of the decline.

British Columbia had the largest increase in commercial building construction in the first quarter, up 3.2% to $913 million. The advance resulted mostly from higher spending on the construction of retail and wholesale outlets as well as warehouses. Ontario closely followed, with higher investment in retail and wholesale outlets, office buildings as well as laboratory and research centres.

Chart 2: Commercial, institutional and industrial components

Industrial component

Investment in industrial building construction decreased 2.5% to $1.8 billion in the first quarter. This fifth consecutive quarterly decline was attributable to lower spending in most industrial building categories.

Construction spending on industrial buildings fell in six provinces. Alberta registered the largest decline, reflecting decreased investment in every industrial building category, mainly manufacturing plants and maintenance-related buildings.

The largest increase occurred in British Columbia, mostly as a result of higher investment in manufacturing plants.

Institutional component

Following seven quarterly gains, spending in the institutional component edged down 0.9% to $3.5 billion in the first quarter. The decline was a result of lower spending on the construction of educational institutions and medical facilities, which more than offset increased investment in nursing homes and government buildings.

Institutional building construction investment declined in eight provinces, with Ontario, Quebec and Manitoba registering the largest decreases. Lower investment in medical facilities and educational institutions explained the drop in Ontario, while decreased spending on educational institutions was responsible for most of the decline in Quebec. In Manitoba, investment in every institutional building category registered declines.

Alberta and Saskatchewan were the two provinces to register advances in the institutional component. In Alberta, the gain was attributable to higher spending on educational institutions as well as nursing homes and retirement residences. In Saskatchewan, the increase came mainly from higher investment in medical facilities.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/160415/dq160415b-eng.htm.

.