Ontario Drives Monthly Downturn in Residential Sector for March 2024 Building Permits

May 16, 2024

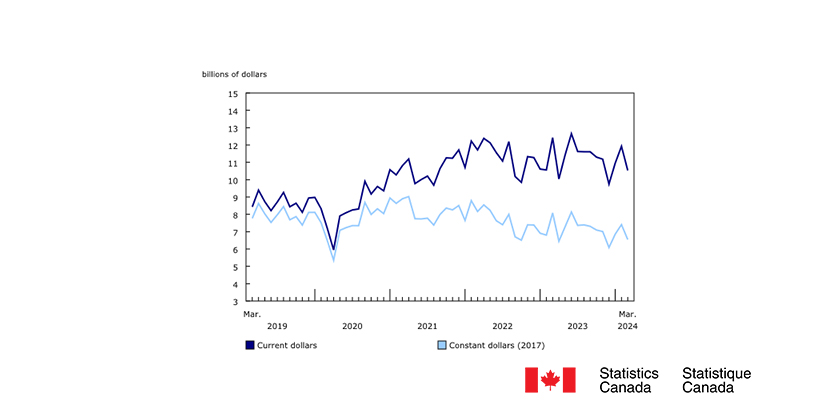

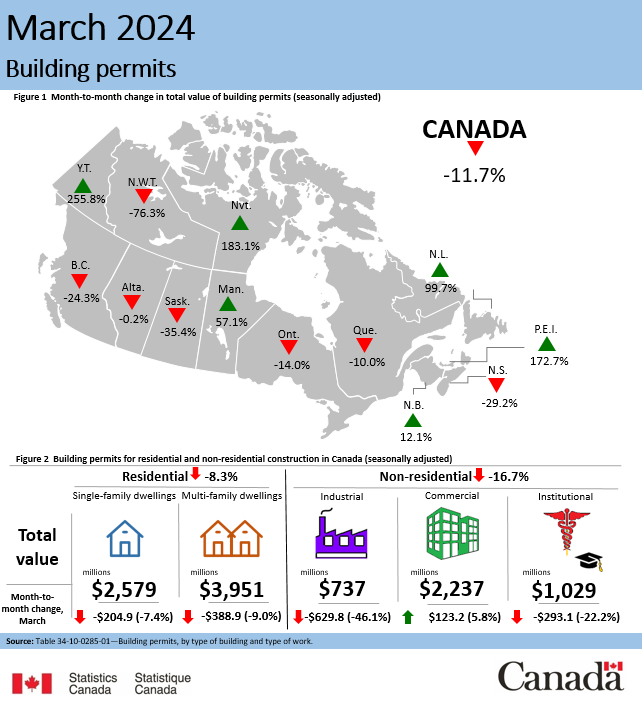

Month over month, the total value of building permits in Canada decreased 11.7% to $10.5 billion in March. Construction intentions in the non-residential component declined 16.7% to $4.0 billion, while the residential sector decreased by 8.3% to $6.5 billion. Declines were observed in all components except for the commercial component.

On a constant dollar basis (2017=100), the total value of building permits fell 11.6% in March, following two consecutive months of increases.

Monthly declines in industrial construction intentions push down the non-residential sector

Non-residential construction intentions decreased 16.7% to $4.0 billion in March, with reductions in the industrial (-46.1%; -$629.8 million) and institutional (-22.2%; -$293.1 million) components. The large decline in the industrial component was due to the lack of major industrial permits issued in March compared with February, which was the second-highest monthly level recorded.

The commercial component tempered the declines in the non-residential sector by growing 5.8% to $2.2 billion in March.

Ontario drives monthly downturn in residential sector

The value of residential building permits decreased 8.3% to $6.5 billion in March. Ontario (-13.7%; -$377.4 million) led the decline in value for both single-family and multi-family dwelling permits. Despite the overall decline, the residential sector grew in Quebec (+7.3%; +$90.1 million), Prince Edward Island (+70.4%; +$14.3 million), Saskatchewan (+10.3%; +$6.3 million), Newfoundland and Labrador (+7.7%; +$2.2 million) and Manitoba (+0.9%; +$1.4 million).

Across Canada, 16,800 new multi-unit dwellings and 4,200 new single-family homes were authorized in March. From April 2023 to March 2024, a total of 260,200 new units were authorized.

First quarter of 2024 rebounding, driven by growth in construction intentions in the commercial component

The total value of building permits in the first quarter of 2024 was $33.4 billion, a 3.7% increase from the previous quarter ($32.2 billion). This represents a partial rebound from the fourth quarter of 2023, which was the lowest quarterly total value since the third quarter of 2021 ($30.5 billion). The growth was driven by British Columbia (+20.1%; +$988.4 million), which posted significant gains in the commercial and industrial non-residential components, and in the multi-unit residential component. Despite quarterly gains, construction intentions in the first quarter of 2024 remained lower than the average quarterly levels of the previous two years.

Construction intentions in the non-residential sector increased 6.9% to $13.0 billion in the first quarter, led by the commercial component (+22.3% to $6.6 billion), which posted the highest level of the previous four quarters. Growth was driven by permits for office buildings. Overall, nine provinces and territories reported increases in commercial construction intentions, led by Ontario (+34.8%; +$710.1 million), Quebec (+31.2%; +$296.6 million) and British Columbia (+32.4%; +$269.3 million).

The value of residential building permits edged up 1.8% in the first quarter. Growth in the multi-unit component (+7.9%; +$919.5 million) was partially offset by declines in the single-family homes component (-6.6%; -$565.6 million).

Go HERE for more information

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 16 Class 1 and Class 2 Circuits](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)