Total Value of Building Permits Decline 13.9% in June, 2024

August 15, 2024

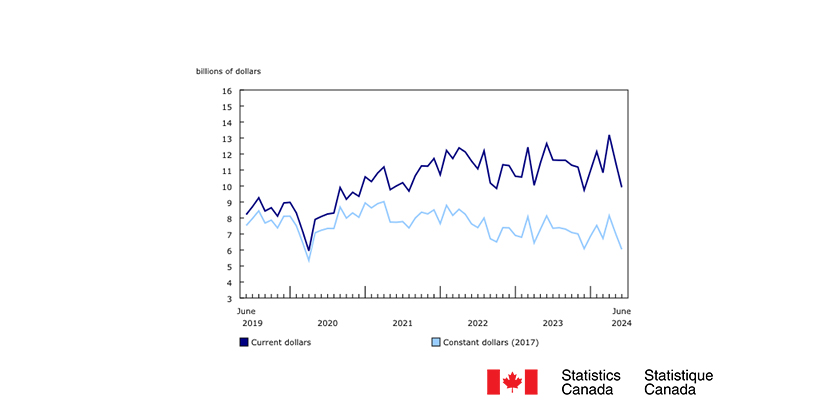

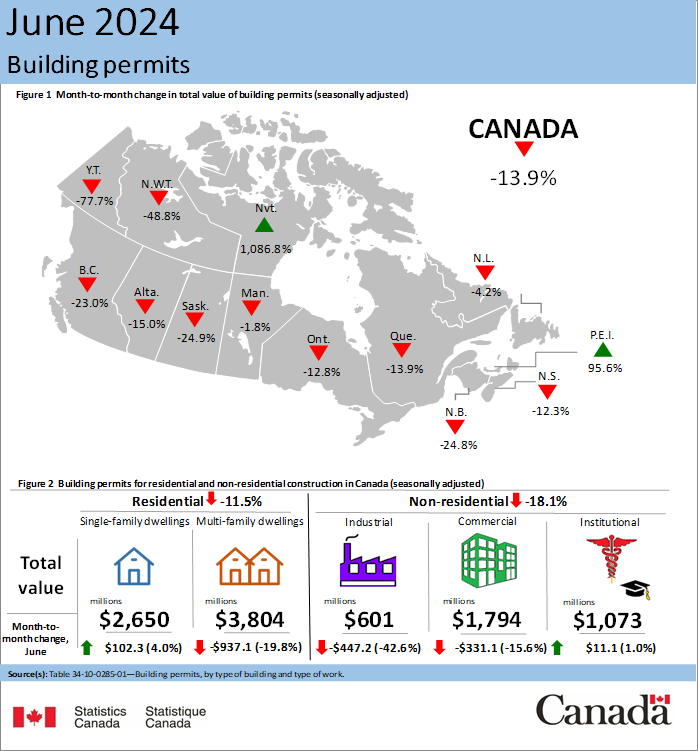

The total value of building permits in Canada fell 13.9% to $9.9 billion in June, extending the decline observed in May. Decreases were reported in 11 of the 13 provinces and territories, with both residential and non-residential sectors experiencing reductions.

On a constant dollar basis (2017=100), the total value of building permits declined 14.3% in June, following a 13.4% decline in May.

Single-family dwelling permits see modest growth amid overall residential decline

The total value of residential permits decreased 11.5% to $6.5 billion in June. Overall, 9 of the 13 provinces and territories contributed to this decline in residential permits.

Substantial declines in multi-unit construction intentions (-19.8%; -$937.1 million) led the overall residential decline in June. Ontario (-25.7%; -$551.2 million) and British Columbia (-31.1%; -$222.6 million) drove the drop in multi-family dwelling permit values, with Ontario reporting the largest monthly decrease since December 2023.

Meanwhile, construction intentions in single-family homes moved up 4.0% to $2.6 billion in June 2024.

In June, Canadian municipalities authorized 20,400 dwelling units, bringing the total over the last 12 months to 263,400 units since July 2023.

Decline in industrial and commercial construction intentions slows non-residential sector

The total value of non-residential sector permits decreased 18.1% to $3.5 billion in June 2024. The industrial component dropped 42.6% (-$447.2 million) in June, following a 21.3% increase in May. Meanwhile, monthly declines in the commercial component (-15.6%; -$331.1 million) outweighed modest gains in the institutional component (+1.0%; +$11.1 million) across Canada.

Ontario drives second quarter gains to a record high in multi-unit construction intentions in Canada

The total value of building permits in the second quarter was $34.6 billion, up 2.1% from the first quarter ($33.9 billion). This represents a second consecutive quarterly increase and the fourth highest quarterly value in the series.

Construction intentions in the residential sector grew 6.9% to $22.2 billion in the second quarter. The growth was driven by Ontario’s residential sector (+20.0%; +$1.5 billion), which posted significant gains in the multi-unit component (+35.0%; +$1.6 billion). This led to a national record of $14.4 billion in the second quarter, surpassing the previous all-time high of $13.2 billion recorded in the second quarter of 2023. The growth in the multi-unit component in the second quarter of 2024 was driven by several significant multi-unit permits issued in the City of Toronto, the largest of which was issued in April and valued at approximately $900 million. Excluding the Toronto census metropolitan area, the total value of multi-unit residential building permits in Canada declined 2.2% in the second quarter. However, growth in the multi-unit component was seen in seven provinces, notably Quebec (+12.2%; +$288.4 million), Manitoba (+61.6%; $150.2 million), Prince Edward Island (+441.7%; +$71.9 million) and Saskatchewan (+107.3%; $69.9 million).

Across Canada, 70,200 residential units were authorized in the second quarter, up 9.1% from the first quarter.

Overall growth in the value of building permits from the first to the second quarter was tempered by declines in non-residential construction intentions. The non-residential sector decreased 5.6% in the second quarter, with all three components declining. The industrial component (-14.8%; -$437.5 million) had the largest decline, followed by the commercial (-3.0%; -$199.9 million) and institutional (-2.7%; -$95.5 million) components.

Go HERE for more information

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)