Winds of Change Blowing a Bit Harder – Discussing Canadian Wholesaler Mergers & Acquisitions

July 19, 2024

By John Kerr & Owen Hurst

The recent acquisition announcements in the past month or so represent a mix of new moves being made in the electrical distribution channel in Canada that we feel demands some close reflection.

The landscape is changing dramatically and quickly with the recent M&A activity that included two one branch independents, a venerable long standing provincial powerhouse and an up and coming national. All these firms were privately held but only one went to another privately held entity with the others going to the number one and number two brands in the county. Also lost in the fray was the sale of a national chain strong in industrial.

This M&A activity is moving at the fastest pace it ever has in Canada.

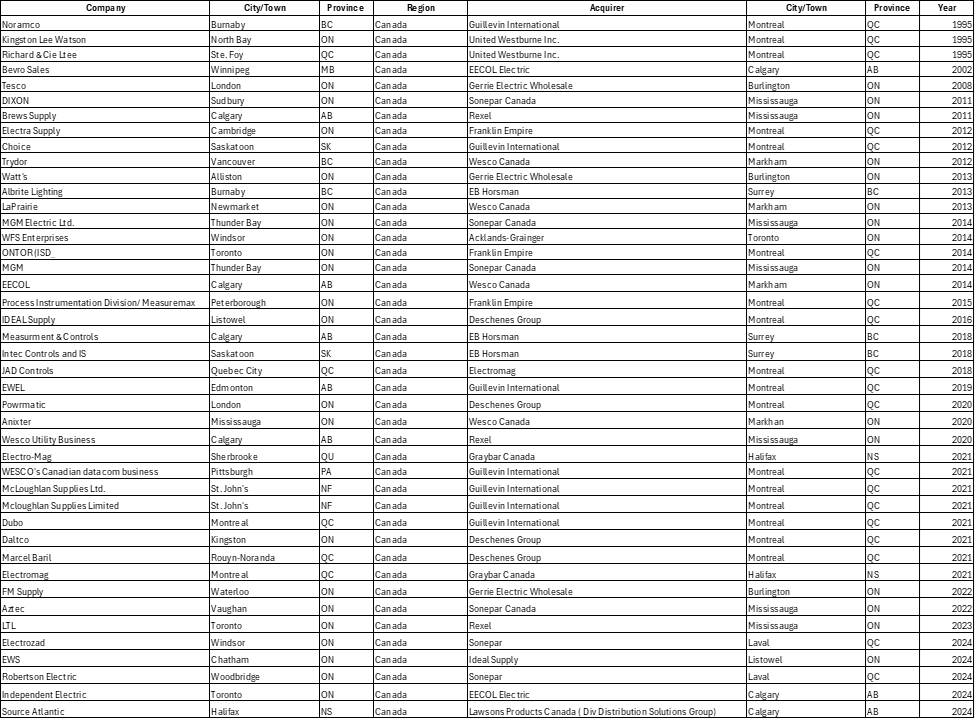

Here is a table of the Canadian M&A activity since 1999:

We see that all the industry leaders have been active these past few years with Guillevin, Rexel, Deschenes, Wesco and most recently Sonepar all picking up key Independents. And there will be more to come. This is such an interesting time too as there are approximately 32 new Greenfield branches planned and, on the books, as of early January this year.

Here is a comparison of how the landscape in Canada has changed according to the Annual Pathfinder report.

| Canada Electrical Distributor Landscape | 2014 | 2023 as at December 31 2023 | 2024 |

| Independent | 13.40% | 2.00% | 2% |

| Marketing Group | 17.20% | 21.50% | 16% |

| Multinational | 69.40% | 76.50% | 82% |

| Source Pathfinder Report | |||

So, underlying all this one can easily see that the larger independents are moving. The revenue shifts alone from these moves approach $600 Million and is affecting the Marketing Groups, dropping their share to a ten year low at 16%.

These moves too have also shifted the relative positions of key companies with Wesco holding the number one spot now followed by Sonepar, Rexel and Guillevin. And we can now recognize that as it remains independent Franklin Empire has regained its position as Canada’s largest privately held independent.

Regionally, Sonepar has significantly improved its position in the Ontario market as well.

And as all this is happening AD in Canada and IMARK Canada have apparently opened discussions mirroring the actions of their US counterparts.

The drivers behind this consolidation trend are multifaceted. Larger distributors seek to expand their geographic footprint, increase market share, and achieve economies of scale. For smaller, often family-owned businesses, selling to larger entities can provide an exit strategy for owners without succession plans or a way to access greater resources and technology to remain competitive. A further driver is the end user that is increasingly relying on distributors for technical expertise and solution services and support.

Looking more broadly we see this consolidation trend having a wider impact impact the entire electrical supply chain in Canada. As distributors grow larger, they gain increased buying power with manufacturers and can potentially offer more competitive pricing and a wider range of products to customers. However, this consolidation also raises concerns about reduced competition and the potential loss of personalized service that smaller, local distributors often provide. Wil History repeat itself. After Ruddy Electric was acquired by Westburne in May 1988, a number of independents were established and then the System integrator channel followed closely.

Looking ahead, the consolidation trend in the Canadian electrical distribution industry is likely to continue to be driven by the ongoing technological changes in the industry, including the growth of e-commerce and the need for sophisticated inventory management systems. Together these factors may drive smaller distributors to seek partnerships or buyouts from larger, more resource-rich companies.

Some Key takeaways

The impact of these acquisitions is substantial:

- Revenue shifts of approximately $600 million have occurred

- Marketing groups’ market share has dropped to a 10-year low of 16%

- The relative positions of key companies have changed, with Wesco now holding the top spot, followed by Sonepar, Rexel, and Guillevin

- Franklin Empire has regained its position as Canada’s largest privately held independent

- Sonepar has significantly improved its position in the Ontario market

Drivers behind this consolidation trend include:

- Larger distributors seeking to expand geographic footprint and market share

- Achieving economies of scale

- Smaller businesses looking for exit strategies or access to greater resources

- Need to adapt to technological changes, including e-commerce growth

- Demand for sophisticated inventory management systems

- End user technical support

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)