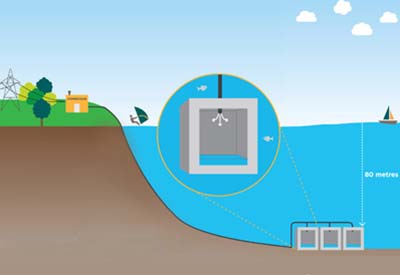

World’s First Utility-Scale Underwater Compressed Air Energy Storage System Activated in Lake Ontario

Located 2.5 km offshore from Toronto, the Hydrostor Corp. underwater compressed air energy storage system is designed to store electricity during off-peak hours when demand is low and electricity is cheapest, and return the stored electricity during times of high demand or during short-term power outages. The storage system, which includes a mechanical facility on Toronto Island, and be operated by Toronto Hydro.

Hydrostor is unique as it uses compressed air and the pressure of water to run its system, and produces zero emissions. The technology works by running electricity through a compressor and converting it into compressed air. The compressed air is sent underwater, where it is stored in large balloon-like structures. When electricity is needed again, the weight of the water pushes the air to the surface through an airline to an expander, which converts the air back into electricity.

Although Hydrostor’s solution has many potential applications, the company will initially focus on developing projects in coastal cities, island nations and micro-grids. These projects may be stand-alone storage systems or combine storage with renewable generation.

“Hydrostor has cracked the toughest nut of cleantech: low-cost grid-scale energy storage,” says Tom Rand, Managing Partner of ArcTern Ventures, an early backer of Hydrostor. “By enabling a flexible and robust grid, energy storage enables massive penetration of renewables at increasingly competitive pricing.”

Highlights of Hydrostor’s solution include:

- capital costs less than half of competing lithium-ion battery technology with over twice the cycle life

- small land footprint, making it ideal for island nations and large coastal cities

- far less environmental impact than pumped hydro

- greater flexibility and substantially increased siting options compared to pumped hydro or cavern-based compressed air solutions.

- commercially available today using proven equipment from 5MW | 30MWh up to over 100MW | 1,000MWh.