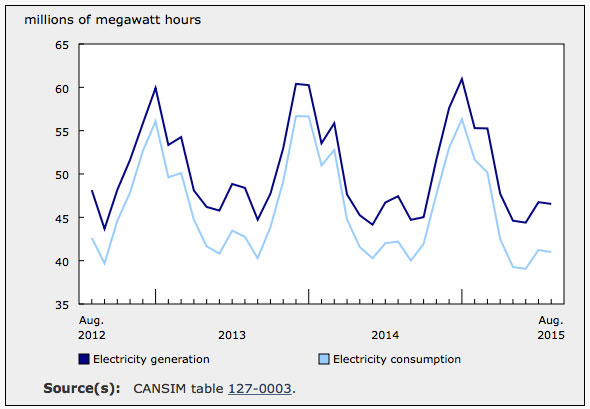

August Electricity Consumption Dips 2.9% YOY

Chart 1: Electricity generation and consumption, August 2012-2015

Canada’s available electricity totalled 41.0 million megawatt hours (MWh) in August, down 2.9% from the same month in 2014. Generation levels were also lower for the month, down 1.9% to 46.5 million MWh, reflecting lower output fin some provinces rom hydro and nuclear generators.

Canada’s electricity exports to the United States increased 1.8% to 6.2 million MWh on higher deliveries from British Columbia. Imports fell by nearly a quarter on a year-over-year (YOY) basis to 0.6 million MWh. Lower receipts from the United States were widespread with British Columbia posting the largest decline.

In Ontario, electric power generation levels totalled 11.8 million MWh in August, a 5.8% decrease compared with the same month in 2014. Lower water inflows to generating stations pushed hydro generation down 24.3% to 2.2 million MWh, more than offsetting small gains in steam conventional, nuclear, solar and wind generation. Lower generation, combined with higher net outflows, pushed total available electricity in August down 7.2% to 10.5 million MWh.

On the east coast, maintenance shutdowns at a nuclear power plant in New Brunswick resulted in a 27.3% decrease in total generation levels, which fell to 0.8 million MWh. Mitigating the decline, output from hydro, combustion turbine and steam conventional generators rose by more than 9% (in each case) on a year-over-year basis. To meet demand, the province increased receipts from other provinces, principally Quebec.

Generation gains of 7.7% in British Columbia and 18.9% in Newfoundland and Labrador eased the national decline in generation levels. Both provinces used their higher generation levels to increase deliveries; exports from British Columbia to the United States rose 57.6%, while deliveries from Newfoundland and Labrador to other provinces were up 27.6%.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/151027/dq151027b-eng.htm?cmp=mstatcan.