January Building Permits Fall 12.9%

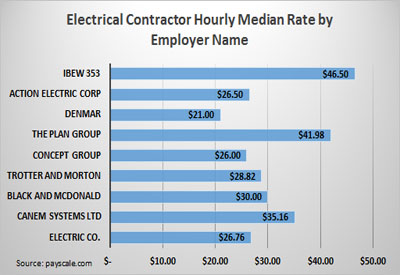

The total value of building permits issued by Canadian municipalities fell 12.9% to $6.1 billion in January, following a 6.1% increase the previous month. Lower construction intentions for non-residential buildings in Alberta, British Columbia and Ontario were responsible for much of the national decline.

Chart 1: Total value of permits

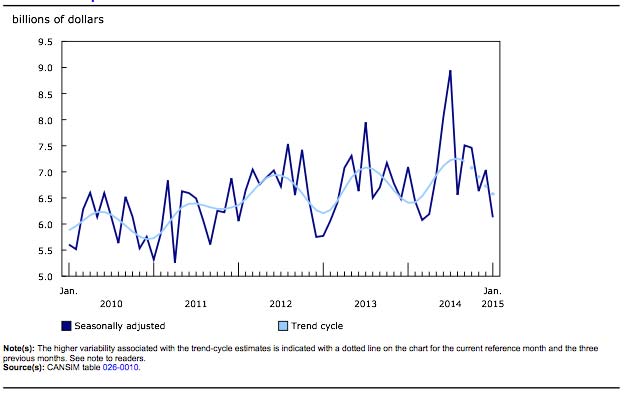

Construction intentions in the non-residential sector fell 22.8% to $2.0 billion in January, following a 15.0% increase the previous month. Decreases were recorded in eight provinces, with Alberta, British Columbia and Ontario accounting for most of the drop. Quebec (+54.3%) registered the largest increase.

In the residential sector, the value of permits declined 7.0% to $4.1 billion, following a 1.5% increase in December. Decreases were registered in every province, except Saskatchewan, as a result of lower construction intentions for multi-family dwellings. Ontario, Quebec, British Columbia and Manitoba posted the largest declines. Saskatchewan posted an increase in the value of both single and multi-family dwelling permits.

Non-residential sector: declines in all three components

Canadian municipalities issued institutional building permits worth $387 million in January, down 49.8% from December. This followed a 15.2% increase the previous month. The value of institutional building permits was down in six provinces, with Alberta and, to a lesser extent, British Columbia accounting for much of the monthly decrease. The decline at the national level was the result of lower construction intentions for educational institutions, medical facilities, and nursing homes and retirement residences. Ontario posted the largest gain in the value of institutional building permits.

The value of commercial building permits fell 8.0% to $1.3 billion, following a 15.1% increase in December. This was the result of lower construction intentions for a variety of commercial buildings, including hotels and restaurants, warehouses and office buildings. Declines were recorded in seven provinces, with British Columbia, Alberta and Ontario posting the largest decreases. Quebec (+110.6%) registered the largest increase in the commercial component.

In the industrial component, the value of permits was down 22.8% in January to $337 million, following a 14.2% increase the previous month. The decrease was mainly attributable to lower construction intentions for transportation-related buildings and, to a lesser extent, manufacturing plants in several provinces. Gains were registered in four provinces in this component, led by Quebec.

Chart 2: Residential and non-residential sectors

Residential sector: lower construction intentions for multi-family dwellings

The value of permits for multi-family dwellings declined 21.0% to $1.5 billion in January, a fourth consecutive monthly decline. This marked the lowest level for the component since March 2013. The decrease in January was the result of lower construction intentions in nine provinces, with Ontario registering by far the largest decline. Saskatchewan was the lone province to post an increase.

Municipalities issued building permits for single-family dwellings worth $2.6 billion in January, up 3.5% from December. This was the second consecutive monthly advance. Increases were reported in four provinces, led by Ontario and Quebec.

Canadian municipalities approved the construction of 14,888 new dwellings, down 7.5% from the previous month. The decline was the result of a 12.9% decrease in the number of multi-family dwellings to 8,510 units. Conversely, the number of single-family dwellings increased 0.9% to 6,378 units.

Alberta, British Columbia and Ontario post the largest decreases

The total value of permits was down in eight provinces in January, with Alberta, British Columbia and Ontario registering the largest declines.

After posting a 32.6% increase in December, which came mainly from permits issued for institutional projects, Alberta registered a 27.2% decrease in January.

In British Columbia, the decline was attributable to lower construction intentions in both the non-residential and residential sectors. Ontario registered a decrease in January on lower construction intentions for multi-family dwellings as well as commercial and industrial buildings.

The largest gain occurred in Quebec, with commercial buildings and single-family dwellings accounting for most of the increase.

Lower construction intentions in most census metropolitan areas

The total value of permits was down in 23 of the 34 census metropolitan areas (CMAs). The largest decreases occurred in Edmonton, Vancouver and Calgary.

The declines in both Edmonton and Vancouver were attributable to lower construction intentions for commercial and institutional buildings. In Calgary, multi-family dwellings, as well as commercial and institutional buildings were responsible for the decline. All three of these CMAs posted notable gains in December.

The largest gains occurred in Montreal, followed by Quebec. In Montreal, commercial buildings contributed the most to the monthly increase, while in Quebec the advance came from the non-residential and residential sectors.

Table 3: Value of building permits, by census metropolitan area – Seasonally adjusted

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/150306/dq150306b-eng.htm?cmp=mstatcan.