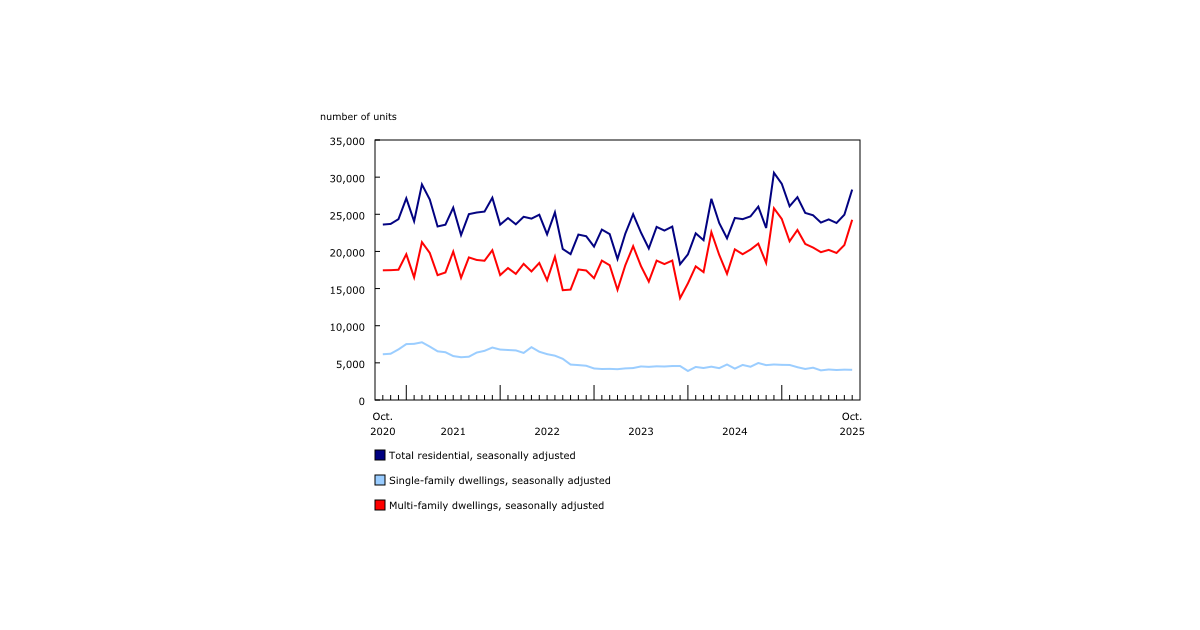

Energy Demand Dips 2.9% in July

Demand for electricity in Canada totalled 40.8 million megawatt hours (MWh) in July, 2.9% lower than July 2014.Reduced demand pushed generation levels down 0.9% from the same month a year earlier to 46.3 million MWh in July, led by nuclear and steam conventional generation.

Electricity exports increased 7.5% to 6.1 million MWh in July, with higher deliveries from British Columbia, Ontario and Quebec. Meanwhile, imports totalled 0.6 million MWh as lower receipts for British Columbia and Alberta pushed overall volumes down 38.2% on a year-over-year basis.

Alberta led the decline in the demand for electricity, down 13.1% to 5.0 million MWh on a year-over-year basis. July marked the 11th consecutive month of year-over-year declines in demand in this Prairie province. Generation levels in Alberta were also down in July, falling 8.9% to 5.0 million MWh on lower steam conventional output.

Chart 1: Electricity generation and consumption

Demand for electricity in Ontario fell 5.4% below July 2014 levels to 10.6 million MWh. This marked the fourth consecutive month of year-over-year declines for the province. Lower nuclear power output pushed total generation levels across the province down 2.7% to 12.1 million MWh. Lower combustion turbine, wind, and internal combustion generation also contributed to the decline. In addition, Ontario’s deliveries to other provinces, combined with exports to the United States, rose 15.1% to 2.0 million MWh.

Mitigating the national decline, Manitoba, Quebec and Saskatchewan all saw increased demand for electricity in July. Despite lower generation levels due to a sharp decline in deliveries, Manitoba was able to meet higher demand (+5.5%) as a result of increased receipts from other provinces. Both Quebec and Saskatchewan met higher demand through increased generation and higher receipts from other provinces.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/150925/dq150925b-eng.htm?cmp=mstatcan.