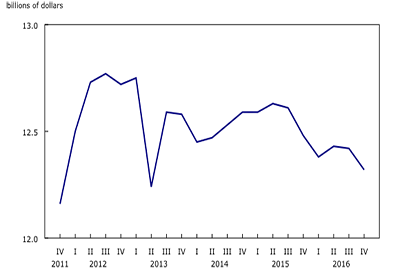

Q4 Non-residential Construction Investment Declines for 7th Time in 8 Quarters

January 20, 2017

Investment in non-residential building construction totalled $12.3 billion in the fourth quarter, down 0.7% from the previous quarter. This marks the seventh decrease in eight quarters. Nationally, the decline reflected lower spending on commercial and industrial building construction.

Overall, non-residential investment fell in six provinces in the fourth quarter, with British Columbia posting the largest decline and Alberta a distant second.

In British Columbia, the decrease was primarily a result of lower spending on commercial buildings. Alberta posted a seventh consecutive quarterly decline, mainly attributable to lower spending on industrial and commercial building construction.

The largest increases were registered in New Brunswick and Manitoba, with both provinces recording a third straight quarterly advance. Increased spending on industrial buildings was the primary reason for the gain in these two provinces in the fourth quarter.

Census metropolitan areas

Spending on non-residential building construction was down in 19 of the 34 census metropolitan areas in the fourth quarter. Vancouver and Calgary recorded the largest declines.

Investment fell 7.5% in Vancouver to $864 million. The decrease was attributable to lower spending on all three components, with commercial buildings accounting for most of the drop. In Calgary, construction spending was down for a fifth consecutive quarter. The decline was largely the result of lower investment in commercial projects.

The largest gains occurred in Edmonton and Winnipeg, where spending on non-residential building construction in both CMAs advanced for the third straight quarter. The increase in Edmonton was largely due to spending on commercial buildings, while a fifth straight quarterly increase in investment in industrial buildings was the main contributor to the gain in Winnipeg.

Commercial component

Spending on commercial building construction fell 0.9% to $7.2 billion in the fourth quarter. The decline nationally was primarily attributable to lower spending on office buildings.

Declines were recorded in five provinces, with British Columbia and Alberta posting the largest drops.

In British Columbia, investment fell 4.3% to $908 million in the fourth quarter. Lower investment in office buildings and shopping centres were primarily responsible for the decline.

In Alberta, investment was down 2.3% from the previous quarter to $1.5 billion in the fourth quarter, marking a seventh straight quarterly decrease. Increased spending on shopping centres was not sufficiently large to offset lower spending on office buildings.

Conversely, Ontario recorded the largest gain in commercial investment where commercial building construction rose for the fourth consecutive quarter, up 0.8% to $2.8 billion in the fourth quarter. The advance was spread across a variety of buildings led by warehouses.

Industrial component

Investment in industrial projects was down 2.8% from the third quarter to $1.7 billion in the fourth quarter. At the national level, the decline was attributable to lower investment in the construction of farm and utilities buildings.

Declines were reported in seven provinces, with Ontario and Alberta contributing the most to the overall decrease in the component.

In Ontario, investment fell 3.9% to $751 million, marking a third straight quarterly decline. Reduced spending on farm and utilities buildings were the leading contributors to the decrease.

Spending on industrial building construction decreased 10.5% to $220 million in Alberta, a seventh consecutive quarterly decline. The decrease was primarily due to lower investment in utilities buildings.

In contrast, Manitoba, New Brunswick and Quebec posted advances. Investment rose in Manitoba for the fifth consecutive quarter, with industrial building construction totalling $74 million, up 18.3% from the previous quarter. Increased spending on utilities and maintenance buildings primarily contributed to the gain. Higher investment on farm and maintenance buildings led to the gain in New Brunswick, while increased spending on manufacturing plants largely explained the advance in Quebec.

Institutional component

Investment in institutional building construction rose 0.5% from the previous quarter to $3.5 billion in the fourth quarter. Higher spending on the construction of nursing homes and retirement residences was largely responsible for the advance nationally.

Investment in institutional projects rose in four provinces, with Alberta and Ontario posting the largest gains.

In Alberta, investment in institutional building construction rose 4.9% to $738 million in the fourth quarter, the 10th consecutive quarterly increase. The advance came primarily from higher investment in nursing homes and retirement residences and, to a lesser extent, health care facilities.

In Ontario, institutional construction investment rose 0.9% to $1.3 billion in the fourth quarter. The advance, driven mainly by increased investment in nursing homes and retirement residences and educational institutions, was moderated by lower spending on health care facilities.

Conversely, Quebec reported the largest decline in spending on institutional buildings. Spending totalled $596 million in the fourth quarter, down 4.0% from the previous quarter. This was the ninth consecutive quarterly drop. Lower investment in the construction of health care facilities and educational institutions led the decrease in the fourth quarter.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/170117/dq170117a-eng.htm.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)