BC Construction Development Cautious in the Face of Economic Pressures and Legislative Delays

October 30, 2023

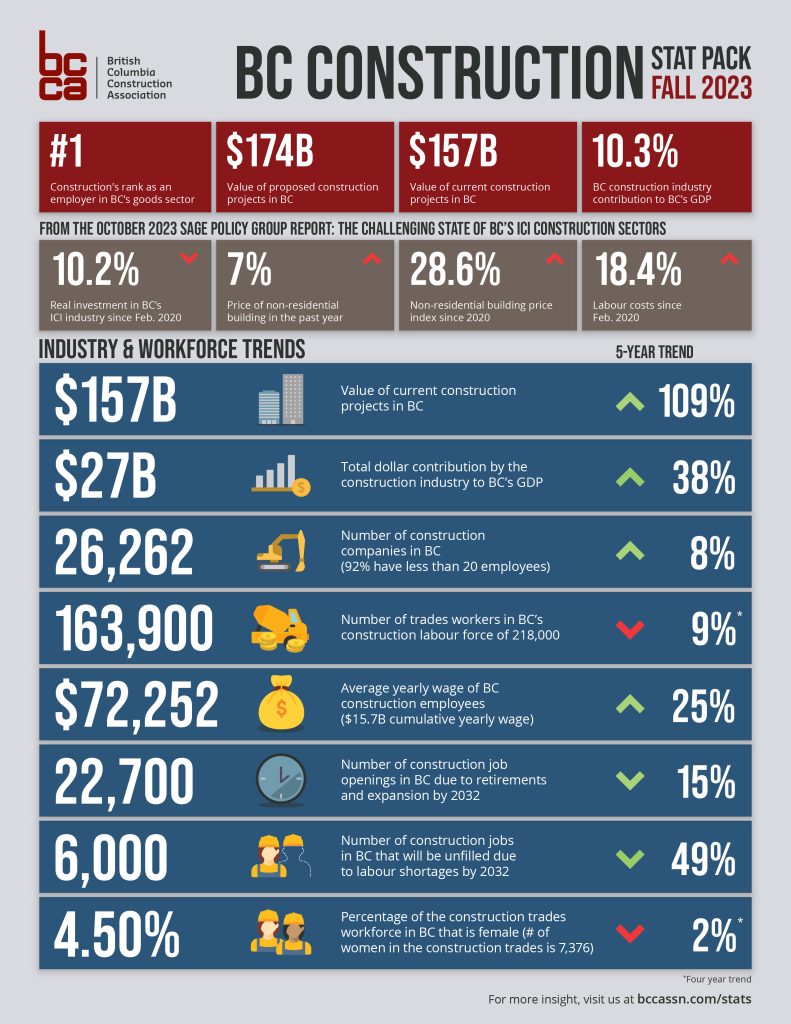

Statistics reported in the Fall 2023 BC Construction Association (BCCA) Industry Stat Pack, combined with findings from an economic and policy report published today by the organization, show an industry in dire need of relief in the form of immediate legislative reform.

Demand for construction remains high in British Columbia, with major projects currently underway at an estimated value of $157B. This represents an increase of 16% over 2022, and 109% over the past five years. However, the estimated value of proposed major projects has dipped to $174B in comparison to $220B last year, signaling possible future decrease in robustness and growing insecurity with regard to economic prospects.

Real investment in B.C.’s industrial, commercial, and institutional (ICI) construction sectors has been essentially flat (-1.6%) through the first half of 2023. It remains over 10% below its pre-pandemic level (February of 2020) in real terms, with institutional and government construction being the singular growth segment in the interim.

Recent improvements in the availability of construction inputs have resulted in a slowing of price increases to non-residential building in the past year, registering at 7% compared to 13% between 2021 and 2022. Labour costs and the non-residential building price index sit, respectively, at 18.4% and 28.6% above pre-pandemic levels.

The ongoing struggle of dealing with decreased commercial demand and rising costs of material and labour, coupled with waning procurement standards on public sector projects, lack of prompt-payment legislation, and a declining workforce, paints a dim picture for contractors over the next few years.

“Construction has never been busier, yet the pressures to meet this demand are equally high. Interest rates, rising wages and the high cost of materials all factor into the equation. It is clear that these pressures are causing layoffs,” states Chris Atchison, BCCA President. “We’ve seen indications that construction workers, both skilled and unskilled, are moving out of the province as a direct result of B.C.’s high cost of living, housing shortage, and the perception of better opportunities elsewhere. Our workforce is invaluable, and we cannot afford to lose a single tradesperson or journeyperson. B.C. needs an effective affordable multi-unit housing strategy aimed at keeping workers like those in the construction sector within the province.”

The provincial government continues to fail to deliver on a simple solution which would provide immediate relief to a struggling construction sector: prompt payment legislation. As B.C.’s contractors wait months for payment, they experience significant financial risk and take on the increased cost of debt, which can put them in danger of bankruptcy. Lien reform including holdbacks and adjudication are additional priorities for B.C.’s construction industry.

“Government seems to be under the illusion that contractors all have the deep pockets needed to essentially fund large scale projects. Not so. About 90% of B.C. contractors are small companies, and they are often paid three or six months after the last nail has been pounded, or the last coat of paint has dried. No other industry has to endure that,” maintains Atchison. “Last Spring, we were encouraged to hear that the Attorney General would be convening a large table working group on this issue. We’re still waiting. The time to talk has passed. The time to act is now. The situation is dire. Unlocking cash flow is an economic necessity and in the best interests of every community in British Columbia.”

Despite 8% growth in the number of ICI construction companies in B.C. over the last 5 years (26,262), the number of tradespeople in the industry dropped 8% over three years, and 9% since 2019. The average company size has contracted by 10% over the previous three years to an average of 6.24 workers.

From the first quarter of 2023 to the second, B.C.’s construction employment base diminished by

14,500 workers, a decline approaching 6%. This represents the worst performance of any Canadian province in both absolute and percentage terms.

“We need to get enough people skilled up to replace the tens of thousands who are retiring in the next few years in British Columbia. One way to do that is to be more diverse about who we hire and train” believes Atchison. “Everyone, including members of traditionally underrepresented groups, should feel welcome within the construction industry. There is absolutely no lack of employment opportunities for anyone interested in exploring a career in construction.”

The complete Stat Pack, economic report from Sage Policy Group, and more information regarding the value of the construction industry to B.C.’s economy can be found at www.bccassn.com/stats

KEY B.C. CONSTRUCTION INDUSTRY STATISTICS:

- Construction is the No. 1 employer in B.C.’s goods sector

- B.C.’s construction industry accounts for 10.3% ($27B) of the province’s GDP

- More than 218,000 people rely directly on B.C.’s Construction industry for a paycheque

- Number of credentialed tradespeople: 163,900

- Roughly 85% of construction workers are non-union

- Number of credentialed tradeswomen: 7,376 (4.5%)

- Number of construction companies in B.C.: 26,262

- Average yearly wage of B.C. construction employees: $72,252 ($15.7B cumulative yearly wage)

- Value of proposed construction projects in B.C.: $174 billion

- Estimated value of current major construction projects underway in B.C.: $157 billion

- Number of construction jobs in B.C. that will be unfilled due to labour shortages by 2032: 6,000

Details regarding data sources can be found at bccassn.com/Stat-Pack-Sources.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)