November Building Permits Show Modest Declines in Residential Sector

January 26, 2024

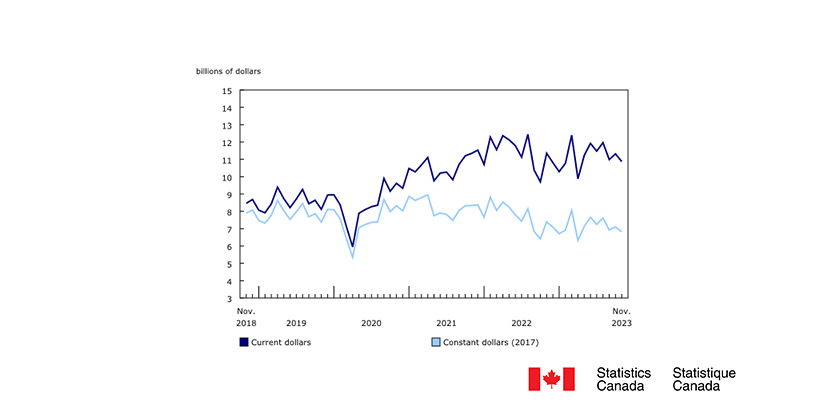

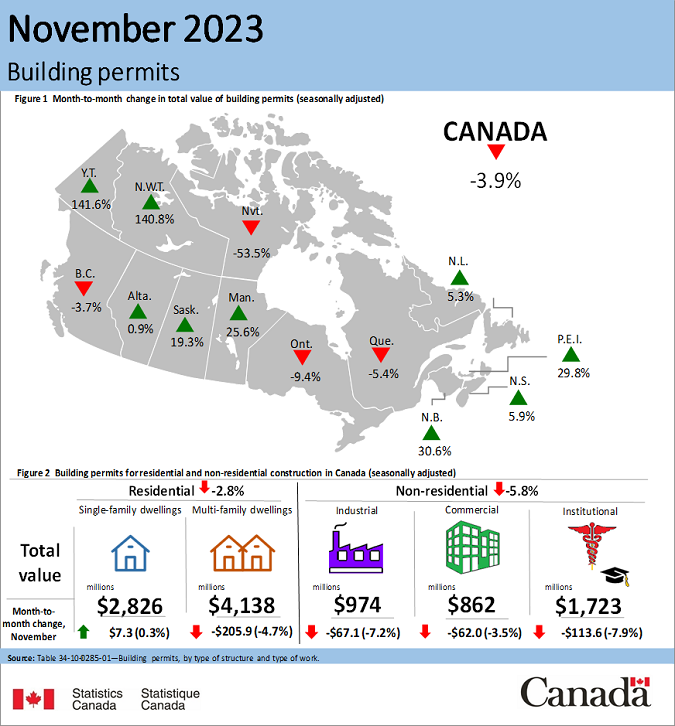

The total monthly value of building permits in Canada decreased 3.9% from October to $10.9 billion in November, with declines posted across almost all building type components.

On a constant dollar basis (2017=100), the total value of building permits declined 3.9% to $6.8 billion in November.

Overall modest declines in residential sector

Despite eight provinces with monthly gains in residential construction intentions, the total value of residential permits declined 2.8% overall to $7.0 billion in November.

British Columbia (-19.4%; -$249.3 million) and Quebec (-17.3%; -$231.0 million), both driven by month-over-month declines in the multi-unit component, more than offset the residential gains in the rest of the country in November.

The Atlantic provinces collectively increased 30.0% in residential permit values to $421.8 million in November, the highest monthly value for the region in the first 11 months of 2023. Similarly, in November, the Prairie provinces ($1.4 billion) posted their highest monthly level in the first 11 months of 2023, up 9.8% from October. To round out residential construction intentions in November, the territories increased 10.6% to $7.4 million, while Ontario edged up 2.1% to $3.0 billion.

Less construction intentions in commercial, institutional, and industrial components

The total monthly value of non-residential building permits decreased 5.8% from October to $3.9 billion in November. All three non-residential components declined, with the commercial component decreasing for the third consecutive month, down 3.5% from October.

Permit values in the commercial component have been trending down since the record high of $2.9 billion in March 2023. Year over year, the $1.7 billion value of commercial permits issued in November 2023 was 16.2% less than November 2022 levels.

On a constant dollar basis, commercial construction intentions were down 18.2% year over year in November, while the overall value of non-residential permits declined 10.1%.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)