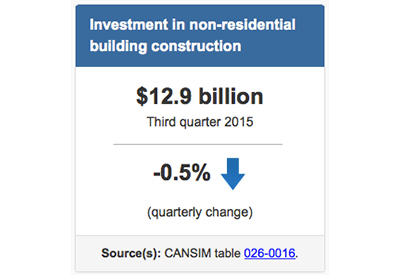

Q3 Investment in Non-Residential Building Down 0.5%, Institutional Up 2.2%

Jan 22, 2016

Investment in non-residential building construction amounted to $12.9 billion in the third quarter, down 0.5% from the previous quarter. This was the third consecutive quarterly decline and largely reflected lower spending on the construction of commercial and industrial buildings.Institutional investment continued to increase, an upward trend that began in the first quarter of 2014.

Chart 1: Investment in non-residential building construction

Overall, total investment fell in four provinces in the third quarter, with Quebec registering the largest decline, followed by Manitoba. In Quebec, the decline was mainly as a result of lower spending on institutional and commercial buildings. In Manitoba, the decrease was attributable to lower spending on commercial and industrial buildings.

The largest increases occurred in Ontario and Alberta. In Ontario, investment advanced in all three components, while in Alberta, it resulted from higher spending on institutional buildings.

Census metropolitan areas

Total investment was up in 23 of the 34 census metropolitan areas (CMAs). However, these advances were not sufficiently large to offset declines in the remaining CMAs as well as the regions outside CMAs.

The largest gain occurred in Toronto, followed closely by Calgary. In Toronto, the increase was mainly attributable to higher investment in the construction of commercial buildings, while in Calgary, the gain was mostly due to higher spending on institutional construction projects.

Montreal reported the largest decline, followed by smaller declines in Kingston and Quebec. All three components were down in these CMAs.

Commercial component

In the commercial component, investment fell 1.3% to $7.6 billion in the third quarter. This was the fourth consecutive quarterly decrease and was attributable to lower spending on commercial building construction in six provinces.

Quebec, Alberta and Manitoba posted the sharpest declines. In Quebec, investment decreased 2.9% to $1.2 billion, and was the result of lower spending across several categories of commercial buildings. In Alberta, commercial investment was down 1.9% to $1.8 billion, a third consecutive quarterly decrease, and was mainly due to lower spending for office and other accommodation facilities. In Manitoba, commercial investment declined 13.6% to $220 million with lower spending in every commercial category except accommodation facilities.

Nova Scotia registered the largest increase, up 10.1% to $126 million, which was attributable to investment growth across several categories of commercial buildings.

Chart 2: Commercial, institutional and industrial components

Industrial component

Investment in industrial projects was down in six provinces, declining 2.5% to $1.6 billion in the third quarter. The decrease was mainly attributable to lower spending on the construction of manufacturing plants and, to a lesser extent, utilities and maintenance buildings.

Alberta was by far the main contributor to the decline. In Alberta, investment fell 15.4% to $301 million, mainly as a result of lower spending on maintenance and utilities buildings.

The largest gain was in British Columbia, with investment rising 13.0% to $130 million, mainly because of higher construction of maintenance and primary industry buildings.

Institutional component

Investment in institutional projects continued its upward trend for the sixth consecutive quarter, rising 2.2% from the previous quarter to $3.7 billion in the third quarter. Nationally, institutional investment rose in seven provinces.

The largest increase occurred in Alberta, where investment rose for the fifth consecutive quarter. Institutional spending increased 22.7% to $629 million. Most of the increase was attributable to higher spending in the construction of educational buildings.

Quebec posted the largest drop in the third quarter, largely as a result of lower spending on the construction of health care facilities. This reflected the near completion of certain large institutional projects in the province.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/151015/dq151015a-eng.htm.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2-768x432.png)

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition– A Road Map: Section 56](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)